ADIA: Saudi Arabia losing market share to Iran, Iraq

"If you're talking about winners, you can count Iran and Iraq," Christof Ruehl said on Wednesday at a conference in Dubai, according to a report by Bloomberg.

In an unprecedented move, OPEC members agreed in November to cut production by 1.2 million barrels per day for six months beginning from the start of the year in a bid to shore up prices.

Some non-cartel producers, led by Russia, joined in December by committing to cut output by 558,000 bpd.

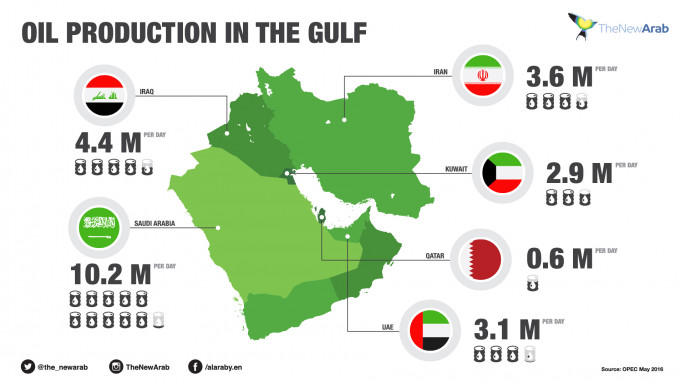

Saudi Arabia, OPEC's biggest producer, agreed to cut output by 486,000 bpd, while Iraq said it would cut 210,000 bpd.

Meanwhile, Iran was permitted to increase output by 90,000 bpd after sanctions restricting its oil sales were lifted following a landmark nuclear deal signed with world powers in January 2016.

Iran's output rose to 3.8 million barrels a day in January, the highest since April 2010, according to data compiled by Bloomberg.

Neighbouring Iraq pumped 4.43 million barrels a day in March, down 200,000 barrels for the year, the data showed.

Saudi Arabia cut production from about 10.5 million bpd in December to as low as 9.87 million daily in January and 10 million a day last month.

The Gulf kingdom knew it would lose share because Iran's production was on the rebound, according to Robin Mills, founder of Dubai-based consultant Qamar Energy.

|

| [Click to enlarge] |

"The Saudis agreed to production cuts at a time when Iranian production was at a high," he said.

Last week, Saudi Arabia's energy minister said that oil-producing countries might have to prolong output cuts in order to achieve the desired rebalancing of the market.

"We might have to extend in order to reach the target... of stock levels," Khalid al-Falih told an energy forum in Abu Dhabi, adding that there was a sort of "initial agreement" on the need to extend the deal after talks in Kuwait last month.

He said producers would continue to assess market figures until next month, when ministers are expected to take a final decision at a meeting in Vienna.

"There was a high level of commitment in the first three months, but despite that, we have not achieved the target" of reducing the supply glut, he said.

The International Energy Agency said earlier this month that the compliance with the agreement among OPEC members and some non-members, including Russia, "has been impressive", giving a lift to oil prices.

But it added that improved prices had attracted higher-cost producers in the United States back to the market, raising the prospect of surprisingly high levels of non-OPEC supply throughout the year.

It said that if OPEC were to extend its output cut, that would boost prices, giving further encouragement to US shale oil producers to pump more.

Oil inventories fell in March but probably showed a rise in the first quarter overall because consumers stockpiled crude before the OPEC-led cuts took full effect, the IEA said.

Agencies contributed to this report

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News