In the period 2008 to 2014, Egyptians experienced an unprecedented number of power outages, with dire consequences that ranged from the suspension of hospital services to the disruption of various lines of industrial production, to the breakdown of ventilation systems during the country’s blisteringly hot summer months.

These outages revealed the severe lack of funding made available to modernize and expand the network of electricity production in the country – with the state primarily relying on self-financing or borrowing from development partners during this period.

At the same time, the state held a monopoly over the processes of electricity production and distribution, while the private sector occupied a limited position in energy production via the build-operate-transfer (BOT) system.

"With the liberalization of electricity prices, the private sector became more involved in the energy sector, both as a funder of infrastructure projects and as an energy producer"

In 2014, in response to the problem of power outages, the state initiated an urgent plan to carry out maintenance on, and to expand, the electricity production network.

This was followed by successive projects to establish large-scale power stations for the production of electricity from gas, involving a number of companies, such as the German company Siemens.

At the same time, the state made legislative amendments that allowed for the expansion of the role of the private sector in the renewable energy sector, which contributed to the return of dependable electricity to Egypt.

The expansion of the electricity production network that took place after 2014 was possible due to the state’s openness to various forms of international commercial finance, notably engineering, procurement, construction (EPC) + finance, through which the companies contracted to implement various projects obtained international loans to finance the power stations themselves.

Meanwhile, the public deficit did not increase. In fact, it was reduced by several means – the most prominent of which was ending the state subsidy system for electricity tariffs.

With the liberalization of electricity prices, the private sector became more involved in the energy sector, both as a funder of infrastructure projects and as an energy producer.

Indeed, the state encouraged such involvement through enacting legislative amendments. In sum, the state abandoned its monopoly over the electricity production process, opened up to new forms of infrastructure financing, and moved away from subsidizing electricity prices for a wide range of income groups.

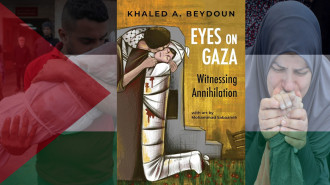

This article analyses the political economy of the liberalization of electricity prices in Egypt, highlighting the main policy shifts in regard to electricity pricing.

It does so by focusing on the role of international finance, including both commercial loans from international banks and financing from international institutions such as the International Monetary Fund (IMF) and the World Bank.

The paper demonstrates how the worsening of the energy crisis in 2014 paved the way for a replacement of public by private financing in the energy sector – a process which saw the institutions of national energy production in Egypt shift from public service providers to private company-like bodies in competition with private sector firms.

At the same time, this article challenges the World Bank’s narrative concerning this transformation.

While the World Bank claims that the fundamental aim of the liberalization of electricity prices in Egypt was to end subsidies to the rich and to redirect resources towards the neediest social groups – and thus, according to the Bank, liberalization was a ‘socio-economic’ reform – in reality, price liberalization paved the way for the entry of international finance, which was presented as a necessity due to the power outage crisis.

While the social element of the so-called reform process is not overlooked, it is argued here that its role was not central. Indeed, the reform has imposed several downward pressures on living standards, such that, at various points, liberalization has achieved the opposite of what was promised in regard to social reform.

After decades of prevarication, liberalization

Electricity production began in Egypt in the nineteenth century. In the 1940s, Egypt issued a law regulating private-sector investments in public utilities.

This law regulated the duration of any concessions granted to companies to provide public services, and the prices the public were to be charged for those services (while ensuring that provision remained profitable). In 1948, a specialized department was established to regulate concessions in the electricity sector.

The private sector continued to be a player in electricity production in Egypt until the wave of nationalizations that took place in the 1960s. The processes of nationalization reflected an ambitious state vision to expand the coverage of the electricity network.

Indeed, in 1964 a public body was established that was responsible for planning the extension of electricity provision across the republic. Seven years later, a specialized department was created for the electrification of the Egyptian countryside.

"The state’s role in electricity production was one element of the ‘Arab socialist’ economic model deployed from the 1960s until the end of the 1980s, under which the state managed the provision of essential services"

The state’s role in electricity production was one element of the ‘Arab socialist’ economic model deployed from the 1960s until the end of the 1980s, under which the state managed the provision of essential services.

Under this model, electricity was sold to the population at prices consistent with prevailing wage levels. In this process, the state played a crucial role in determining job availability within the private sector.

However, the worsening of the external debt crisis through the latter half of the 1980s prompted the Egyptian state to embark upon a comprehensive programme to dismantle the ‘Arab socialism’ model – a move which was also a conditionality of a loan from the IMF received in the 1990s.

The essence of the programme was the withdrawal of the state from the economy in order to give the private sector space to expand, and to end price-distorting policies such as controls over interest rates and both currency and commodities exchange, as well as opening up the country to external financing in lieu of central bank borrowing (i.e. printing money).

|

Adjusting the electricity price tariff was one of the propositions put forward in the new economic programme of the 1990s, with the aim being for the price of energy to match the actual cost of energy by 1995. However, this was not achieved.

The retreat from liberalization of the electricity sector was one of several instances in the 1990s of the state withdrawing from its commitment to the IMF measures due to fear that it would cause popular discontent. Decades of ‘Arab socialism’ had contributed to the politicization of economic life; relinquishing this political responsibility demanded a gradualist approach on the part of the state.

In contrast to the resolute efforts of the state to withdraw from its social role during this period – clearly embodied in the acceleration of privatization within the state industrial sector in the 1990s – there was a great deal of prevarication over the liberalization of both fuel and energy prices. On this basis, it is clear why the 1990s and 2000s saw many legislative amendments that aimed to liberalize the electricity sector.

However, despite these amendments, the sector largely continued to operate in the same fashion as it had over the previous decades. Thus, in one of its papers, the World Bank describes the dynamics of liberalization during this period as involving more a change in appearance than in substance.

One such apparent change was the 1993 transfer of responsibility for electricity distribution from the Ministry of Electricity to the Ministry of the Public Enterprise Sector. The latter was a newly-created ministry, the role of which was to manage the greater part of both the public industrial and services sectors. Importantly, the ministry had the ability to dispose of their assets, including the ones relating to electrical energy. This transfer of responsibility between the two ministries was seen as a step towards the privatization of public entities under the new ministry’s control; however, again, this did not occur.

In 2000, the public electricity production and distribution companies, as well as the Egyptian Electricity Transmission Company (EETC), were merged under a holding company. Within this new form, these companies were in a position to be able to offer a percentage of their shares as an initial public offering (IPO). However, once again, this did not occur.

In 1996, an important legislative amendment was made to the law regulating the Egyptian Electricity Body, which allowed for the proliferation of a novel form of exploitation under the BOT system, albeit with provisions for the return of the assets concerned to the government after an agreed period. This was the most serious attempt to liberalize the electricity sector to take place in this period. The amendment was largely consistent with the aims of the fiscal policies of the late 1990s, which focused on reducing the budget deficit.

However, because liberalization was only partial, the conditions were not ripe for the continuation of the BOT system. While the 1996 amendment enabled the private sector to step into energy production, the Ministry of Electricity continued to hold a monopoly over the purchase of energy from companies.

In light of the ministry’s commitment to maintaining prices at a specific level for the end consumer, investing with the state remained risky – crises had the potential to widen the gap between the price at which the private sector sold electricity to the state and the price at which it was sold to the end consumer. In such a scenario, the state might be unable to meet its commitments to the private sector.

"Since the state’s contracts with private sector electricity producers demanded it adjusts prices in line with changes in exchange rates, the cost of its commitments were likely to become exorbitant"

This risk seemed still more probable after Egypt was forced to devalue its local currency in 2003 as a result of two major crises: the East Asian financial crisis, and the damage to the tourist industry incurred by terrorist acts.

Since the state’s contracts with private sector electricity producers demanded it adjusts prices in line with changes in exchange rates, the cost of its commitments were likely to become exorbitant. Hence, the state reneged on its plans to expand the usage rights of independent producers. Thereby, only three independent producers got these usage rights and came to account for approximately 10 per cent of all electricity production in Egypt.

In this period, the state continued to expand in the field of electricity infrastructure, relying on financing from state-owned banks and development partner countries to do so. This occurred alongside the application of limited increases to the tariffs charged to end consumers, which the World Bank deemed to be insufficient to meet the real price of electricity production, in view of inflation.

By the end of the first decade of the 2000s, the contradictions within the electricity subsidy model had reached a critical point. The public treasury was unable to finance the expansion and adequate maintenance of electricity production and distribution networks.

This was due to two factors: first, the rapid growth of demand, which was reinforced both by the expansion of service across almost the whole of Egypt, and energy-intensive investments attracted by cheap energy pricing; second, the fact that public spending was severely restricted by the policy of deficit reduction, and the implementation of non-progressive tax policies, as a means of attracting investment, which limited the collection of public revenues.

In terms of electricity transmission, Egypt’s loss rates were relatively high, as a result of both the poor quality of the distribution networks and the theft of electricity (reaching 15 per cent of the total energy produced, according to the Ministry of Electricity). Furthermore, the efficiency and availability of power stations were five to eight per cent under the accepted average.

Moreover, power stations operated according to the ‘normal cycle’ system, one major shortcoming of which is the high levels of fuel consumption involved: only 40 per cent of the fuel used produces electricity, with the remainder waste. Due to the continued dependence on traditional fuels such as natural gas and mazut (fuel oil), any shortages of, or increases in, the price of petroleum products causes a crisis in regard to the production of electricity.

With the entry into the 21st century, such a crisis arose due to a drastic decrease in the availability of petroleum products, for various reasons. In fact, during the second decade of the 2000s, Egypt’s position shifted from being a net exporter to being a net importer of petroleum products. This reliance on imported fuel inputs to generate electricity worsened the production cost crisis.

The decline in the production of petroleum products was not simply the outcome of natural causes pertaining to resources in Egypt. Energy subsidies for the end consumer – including fuel for cars, energy for industry, and electricity for consumers – alongside the scarcity of financial resources, also contributed to widening the gap between the price of petroleum products purchased from oil extraction companies, the majority of which were (and continue to be) foreign companies, and the price of the final energy product. As a result, the state’s accumulated inability to pay what was owed to extraction companies led the latter to reduce their investments in Egypt.

After the momentous events of the January 2011 revolution, due to the instability of the regimes that followed, the Ministry of Petroleum withdrew from new exploration agreements, a decision also fuelled by Egyptian Gas companies’ latent anger at the 20-year-long period of fixing the purchase price of foreign partners’ shares.

Hence, the weak investment rates in the energy sector and the decline of petroleum resources led to a greater dependence on imports, which, in turn, increased the costs of petroleum inputs for electricity production, putting the subsidy system under still greater strain.

Due to general political instability and the deterioration of foreign exchange reserves after the January 2011 revolution, the government persisted in the policy of imposing power cuts in order to reduce costs. These power cuts took a heavy toll in terms of public discontent within private households – the major electricity consumers – and economic losses in both the production and service sectors. These developments paved the way for the accelerated liberalization of the electricity sector, and the further integration of the private sector into the energy production system, whether as a funder of governmental projects or as an independent producer.

In this period, international financial institutions pushed for the dismantling of the electricity system created in the 1960s, as the only solution to the sector’s crises. These institutions argued that through the liberalization of fuel and electricity prices, it would be possible to reduce unnecessary energy demands, such as wealthy families’ increasing reliance on energy-intensive air conditioning. Additionally, the same institutions proposed curbing support expenditures (subsidies), which, they argued, significantly contributed to the budget deficit.

|

These international financial institutions argued that liberalization would transform the Egyptian Electricity Holding Company (EEHC) from a net loss-making body into a profitable one, which, they argued, would make its contracting parties, particularly international funders, more favourable towards it. Moreover, it was argued that liberalization would also aid the rapid development of infrastructure while improving efficiency and reducing energy waste.

Ultimately, liberalising the tariff on electricity produced from natural gas will increase the competitiveness of renewable energy. Indeed, liberalisation would make the market of renewable resources attractive to the private sector. It would lead to investment in solar and wind-powered electricity plants, diversify electricity resources, and reduce the potential of crises emanating from the lack of traditional fuels.

The following section explains the ways in which international finance was utilized to eliminate the growing problem of power cuts, paving the way for the accelerated liberalization process, which moved the electricity sector away from state control.

The origins and development of liberalization

The summer of 2014 saw the highest number of power cuts since the beginning of the crisis. The average disconnected load reached 6,050 megawatts, almost double the rate of cuts in 2008. During that year, the Ministry of Electricity had no access to resources and so it failed to implement approximately a third of power station maintenance plans. As a result, the inability to create sufficient energy to meet demand was intensified, particularly in the context of warmer weather (with the consequent greater need for air conditioning).

In 2014, the state initiated an urgent plan to confront the energy crisis and strengthen electricity production. The plan’s main objective was to complete overdue works and to create up to 3,636 megawatts of new energy capacity. Funding for these new projects was secured through EPC+ finance, construction and financing, and procurement contracts, which enabled contractors to search for sources of funding.

"The summer of 2014 saw the highest number of power cuts since the beginning of the crisis. The average disconnected load reached 6,050 megawatts, almost double the rate of cuts in 2008"

The medium-term governmental plans were highly ambitious. Adopting an expansionist vision, the state chose to pursue the most fuel-efficient strategy: it aimed to complete works on three new large-scale combined-cycle power plants. These plants produced a massive upsurge in the levels of electricity power produced in Egypt after 2014, with a combined capacity exceeding 14,000 megawatts. Their cost was, naturally, exorbitant, at 6 billion euros.

These massive funds were arranged through the same logic of the urgent plan: the contractors implementing the projects acted as intermediaries who arranged loans for the state. While local and international banks were contracted to provide the financing, the loans were guaranteed by European support, notably, through the German export credit agency Euler Hermes and the Italian export credit agency SACE. These funds for these new sources of energy were collected for the EEHC (public company).

This period therefore witnessed a marked increase in the number of EPC + finance infrastructure financing contracts. Contractors in the construction industry saw this as a golden opportunity for the government to expand the provision of financing.

For instance, Osama Bishai, CEO of Orascom Construction, one of the most prominent contractors implementing new power plants, commented on this form of financing in a media interview: ‘Why should the government bear the burden of debt and its service when someone else can bear it for them?’ Nonetheless, electricity marketization actually meant that the debt would be repaid by the consumer, not the state, as had already begun to happen after the liberalization of electricity tariffs.

In addition to opening up to external financing, during this period the state also introduced new legislation to encourage the private sector to take part in electricity production and sales to the national network, which, with tariff liberalization, had become more attractive.

By now, the risks for the private sector were drastically reduced: it was no longer expected that a large gap would arise between the EEHC’s purchase price from independent producers and its selling price to the public, which might in turn result in the EEHC’s failure to pay those producers. In this context, a law was passed in 2014 regulating the private production of electricity from renewable sources and its sale to the state.

The law introduced a ‘feed-in’ tariff – a tariff approved by the state as meeting the price for purchasing electricity from private companies, based on the actual cost of the energy produced. A year later, another law was introduced to regulate the electricity sector. Observers have argued that this 2015 law brought about a major advance in the liberalization of the electricity sector since it included clauses that explicitly broke the state’s monopoly over electricity production.

The law also gave EEHC a period of eight years to restructure its subsidiaries such that they will be able to operate in an increasingly competitive market. Furthermore, the law placed the Egyptian Electric Utility and Consumer Protection Regulatory Agency (EgyptERA) at the top of the electricity sector (the agency had existed since 2000, but had previously played only a marginal role), granting it robust powers, notably to set electricity tariffs ‘according to economic rules and foundations’.

This represented a transfer of the mandate that had, for decades, been placed in the hands of the government. Thus, the mandate to set tariffs was transferred to a body that is independent of the government, with a strong representation of the private sector on its board of directors, including CEOs of the Federation of Egyptian Industries and the Federation of Egyptian Chambers of Commerce.

Although the 2015 law enables the government to continue to subsidize electricity, it was treated as an exception to the rule. The law allows the Council of Ministers to bridge the difference between the cost and the (required) sales price, through subsidies, if the service is provided at a tariff that is lower than the one set by EgyptERA. This clause aims to ensure social stability in the case of price hikes.

Noteworthy is that the law, with its radical shift away from the stability of the 1960s, was not a product of 2015, i.e. being conceived after the outage crises. According to a World Bank study, it began to be conceived by state officials in 2005, following international consultations provided to the Egyptian government on the subject. Indeed, a study by Merrill Lynch submitted to the Egyptian government in 1996 offered recommendations that are very similar to the clauses contained in the 2015 law.

Outcomes of openness to external finance

Overall, the policies of openness to external finance, both in terms of the construction of infrastructure and legislative amendments, have led to the diversification of energy sources and an increase in power generation capacities.

The graph above demonstrates a considerable shift in production levels relative to consumer demand, after a period of close convergence between nominal capacity (i.e. energy production capacity) and peak load (i.e. demand). Since 2013, nominal capacity has increased at a quicker rate than energy demand. As a result, some observers have argued that the recent expansions were unnecessarily large and that the returns from these energies are unclear. Mohammed Younes, a scholar specializing in the energy sector, has referred to this as ‘the burden of surplus electricity’.

"The policies of openness to external finance, both in terms of the construction of infrastructure and legislative amendments, have led to the diversification of energy sources and an increase in power generation capacities"

EEHC’s financial statements show how both higher fees and openness to borrowing have increased investments in infrastructure. More specifically, in the years following 2014, revenues and loan balances both rose rapidly.

Regarding the diversification of energy sources, the capacity of solar and wind power plants to generate electricity grew by nearly 100 per cent within one year between 2017/18 and 2018/19.

Such a leap has been enabled by private sector investments in the energy sector, aided by the state and within the regulatory framework of the recent legislation. The first, traditional, approach involved contractors establishing electrical plants for the state.

However, since this approach was first adopted (to establish gas-powered stations before 2014), the state has developed a stronger interest in the generation of solar and wind energy. The second approach, also closely related to the state, is referred to as ‘feed-in tariff investments’, an example of which is the Benban platform, through which the state allows private groups to construct solar plants while pledging to purchase the resulting energy over the long term (25 years), with a return of 8.4 cents to the dollar for every kilowatt.

A final approach involves private renewable energy companies, setting up stations generating energy that is provided directly to consumers via the system of ‘independent producers’. There is also another important mechanism that enables various consumption sectors connected to the electricity network to establish their own plants and produce renewable energy. It allows those sectors to have offsets against what they produce and consume from the network, which, in turn, helps them to reduce the value of the electricity bill.

|

In summary, international financing has not only succeeded in extricating Egypt from the electricity production crisis but ended up pushing for unnecessary electricity projects.

However, this form of financing came with the condition of dismantling state control over the electricity sector and has increased the dominance of private companies over the public service of providing electricity. However, international financial institutions, particularly the World Bank, argue differently. They describe the commodification of electricity as presenting ‘social reforms’ that redirect support to those most in need – an argument that will be tested in the following section, through an inquiry into the social effects of the recent changes to electricity provision.

The social impacts of electricity liberalization

‘I am against wasting subsidies’ was the slogan of a government propaganda campaign during the period of electricity liberalization, an initiative hailed by the World Bank as reflecting the energy reform policies it had recommended to numerous countries via its Energy Sector Management Assistance Programme (ESMAP).

The impact of international finance on electricity policies in Egypt was not limited to commercial finance, which sought to marketize the sector’s institutions: the sector was also influenced by funding from development organizations, whose position was that the subsidized tariff benefits the rich.

Further, these same organizations argued that ending subsidies would prevent the further wasting of resources on non-eligible people. The World Bank, alongside the African Development Bank and the French Development Agency, provided a $3.1 billion loan to Egypt to support electricity liberalization and other reforms. Additionally, scrapping electricity subsidies was part of an economic reform programme financed by the IMF in 2016 with a $12 billion loan.

The World Bank’s criticism of the electricity subsidy system focuses on the link between higher incomes and higher electricity consumption. As the wealthier classes use more air conditioners and electrical appliances in their homes, it is argued that they receive the biggest proportion of electricity subsidies.

The chart below summarizes the World Bank’s arguments about how various social classes benefit from support, both at the level of public goods and services as well as the obligations that indirect taxation imposes on them.

The chart shows that the upper classes' share of benefits of electricity subsidies reaches 40 per cent, while the lower classes receive just 10 per cent, according to the World Bank’s own estimates. In line with this chart, the World Bank recommends avoiding this waste and redirecting financing to sectors that benefit the poor more, such as free public education.

Upon first glance, the World Bank’s arguments seem logical, and they imply a change in our perception of the energy reforms: according to it, liberalization is not a process of privatization but rather a review of the waste of financial resources, which further accentuates the state’s deficit and disrupts the financing of electricity infrastructure. However, what happened on the ground differed from the World Bank’s narrative. Its flawed argument can thus be addressed through the following counterarguments.

"The impact of international finance on electricity policies in Egypt was not limited to commercial finance, which sought to marketize the sector’s institutions: the sector was also influenced by funding from development organizations, whose position was that the subsidized tariff benefits the rich"

First, the electricity sector is distinctive from other forms of universal subsidies. Since high consumption of electricity is generally linked to higher income groups, and vice versa, in the case of low consumption, it is possible to differentiate the income levels of subsidy recipients.

In this context, groups with the lowest consumption levels could have been exempted from the alarming increases in electricity bills, which could have acted as an outlet for providing support to those in need. However, this was not done. The World Bank argues that groups with lower consumption levels were paying bills that were much lower than the actual cost of electricity. In other words, they were partially subsidized. Here, a crucial question poses itself: Why were they not completely exempted from the tariff increase: that is, why was the electricity subsidy not fully maintained?

In fact, during the ‘reform’ period, new fees were introduced under the guise of ‘customer service’ charges, and they were subject to rapid yearly increases. These fees were imposed upon all electricity-consuming segments of the populace, without any exemptions for groups with lower rates of consumption.

|

Second, the concurrence of the process of electricity liberalization with a variety of impoverishing measures – which formed part of the reform programme supported by international financial institutions since 2015 – is not taken into consideration in the World Bank’s argument.

Such measures included increasing value-added tax (VAT) and liberalizing fuel prices. These ‘reforms’ have led to a sharp increase in inflation rates, particularly as the central bank left the local currency to the whims of supply and demand in November 2016. As a result, the local currency lost more than half its value against the US dollar, giving a strong impetus to inflation in 2017.

Third, in the face of inflation, the vulnerable classes were pushed into further poverty as compensation measures were severely lacking. The high poverty rates in 2018 demonstrate the irreversible impacts of such economic patterns. Despite the slight decline in poverty rates in 2020, they did not return to pre-reform levels.

Fourth, there are several criticisms of the means-tested assistance policy that is offered by financial institutions as an alternative to generalized forms of support like electricity subsidies (such as the ‘Takaful and Karama’ cash pension programme in Egypt).

Criticisms of means-tested assistance revolve around the unavailability of adequate state-level data infrastructure for targeting beneficiaries. A gradual move away from universal forms of support, as opposed to a fast-paced transition that relies on targeted cash support, would have had better outcomes.

Indeed, cash support in Egypt does not come with clear requirements connecting the value of the support to inflation. Thus, its value was quickly eroded during the inflationary period that accompanied the reform process.

"For decades, the Egyptian state had a monopoly on the production and pricing of electricity, which helped maintain a certain level of family-based subsidies"

Fifth, the World Bank’s argument focuses on the distinction between the poorest and the richest benefiting from electricity subsidies while failing to account for the position of the middle class in between. In fact, segments of the middle class are vulnerable to falling into poverty due to economic pressures, such as increases in energy prices.

Additionally, if it is to be assumed that reducing electricity subsidies and targeting the poorest with cash support programmes will reduce poverty in the long term, it still remains true that such policies lead to a deterioration in the quality of life of the middle classes. Indeed, these policies diminish the spending ability of the middle classes in sectors such as education and healthcare, in favour of covering basic living expenses such as energy for the home.

Lastly, there has been insufficient spending on those subsidies that the World Bank deems to be more influential for groups with the lowest levels of income. Indeed, many human rights organizations have criticized the government’s failure to provide the minimum spending on healthcare and education stipulated in the 2014 Constitution.

|

Conclusion

For decades, the Egyptian state had a monopoly on the production and pricing of electricity, which helped maintain a certain level of family-based subsidies. However, this financing model was not sustainable, due to the growing difference between the prices of imported petroleum products and the price paid for energy by the end consumers.

Further, the state’s commitment to ensuring a low budget deficit affected its ability to broaden investment in infrastructure in the electricity sector. With the growing crisis of power outages – a result of limited petroleum resources and inadequate infrastructure – the state moved reluctantly towards implementing measures about which it had hesitated for decades.

Such measures included opening up the electricity sector to the private sector, both as electricity producers and as financiers of electricity infrastructure. This penetration by the private sector, alongside the increased price of petroleum products, required the liberalization of electricity prices.

Within the span of a few years, Egypt has made strides in transforming its electricity production sector into one that is free from state control, although the state remains a major energy producer. This privatization of the electricity sector stands in stark opposition to the support policies that Egyptians have benefited from for decades.

The liberalization of the electricity sector is one of the main features of the energy transition process in Egypt. This transition has helped make the financing of the electricity sector more sustainable while protecting the sector from crises relating to financing infrastructure and reducing dependence on traditional fuels in favour of renewable energy. But is the energy transition taking place in Egypt just?

The concept of ‘just transition’ was developed in the United States in the 1970s. In the following decades, with growing demand for just policies to shift energy sectors towards less reliance on polluting sources, the concept gained prominence. A just transition implies a more environmentally sustainable and more equitable energy sector, especially with regard to the various social classes that are dependent on energy.

In Egypt, international finance has principally impacted the formulation of energy policy regardless of its social dimension. This is evident in the unfolding of the process of electricity liberalization, which occurred in conjunction with austerity measures that worsened the social crisis facing the country. Examples of those latter measures include liberalizing fuel prices, increasing public transportation costs, and increasing the VAT.

The World Bank has argued that traditional subsidy policies through electricity tariffs were a waste of resources since the majority of high consumers were deemed to be from higher income groups. It views ending subsidies and channelling money towards social benefits for lower-income groups as the best course. However, lower-income groups have not been immune from electricity tariff increases, and, indeed, the liberalization process took place at an alarming pace, placing huge pressure on the middle classes.

Any discussion of a just energy transition in Egypt must factor in an analysis of who, on the one hand, controls the resources of the energy system, and who, on the other hand, benefits from their usage. While international finance ensures the financial sustainability of the energy system’s infrastructure, it is also radically transforming a basic service into a commodity – and is often the first and the last voice shaping Egypt’s social policy.

This article originally appeared in The Transnational Institute (TNI), an international research and advocacy institute committed to building a just, democratic and sustainable planet.

Mohamed Gad is an economic journalist who, since 2004, has specialized in the Egyptian economy. His work is published in local and international newspapers, as well as on independent news websites. He has published academic work with independent research centres and human rights organizations and has edited four books on the Egyptian economy published by Dar al-Maraya

![Egyptian soldiers walk in front of a newly constructed combined-cycle power stations on the outskirts of the capital Cairo [Getty Images]](/sites/default/files/styles/medium_16_9/public/2023-01/GettyImages-1004580056.jpg?h=69f2b9d0&itok=nnzEaorc)

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News