Throughout 2022, the influence of Gulf Arab states on the international stage increased. While US President Joe Biden and other Western leaders have courted Saudi Arabia’s Crown Prince and Prince Minister Mohammed bin Salman (MbS), many European countries have turned to Gulf Cooperation Council (GCC) members for assistance with energy challenges in light of the Russian invasion of Ukraine.

Both trends highlight how a host of international circumstances enabled Gulf Arab nations to remind actors worldwide of their importance in global affairs.

Over the past 12 months, GCC states made it increasingly clear that they are independent players. These countries pursue their own interests as they are busy navigating an increasingly multipolar world amid intensifying great power competition.

The visit paid by Chinese President Xi Jinping to Riyadh earlier this month and the extent to which Saudi Arabia and Russia cooperated on energy policies against the backdrop of the Kingdom maintaining a relatively neutral stance on the Ukraine war showcased Riyadh’s determination to assert autonomy from Washington as the Saudi leadership’s frustration with the US continues to grow.

Naturally, it is difficult to predict how developments in the Gulf will play out in 2023. Yet, there are some important trends to monitor and potential scenarios to consider as 2022 wraps up.

"A host of international circumstances enabled Gulf Arab nations to remind actors worldwide of their importance in global affairs"

Reuniting the GCC family

Saudi Arabia and the United Arab Emirates (UAE), which blockaded Qatar from mid-2017 until early 2021, improved their relations with Doha throughout 2022. This overall warming of relations among countries in the GCC family is set to continue, both at state-to-state and people-to-people levels. The World Cup which wrapped up earlier this month in Qatar has much potential to serve as an accelerator.

It was significant how MbS and UAE President Mohammed bin Zayed (MbZ) met with the Emir of Qatar in Doha during the World Cup. Such convivial meetings between these three leaders in Doha were unimaginable when the blockade of Qatar was in place between mid-2017 and early 2021.

“The [number] of Saudis who travelled into Qatar to see games and all the anecdotal reporting that I’m hearing is that they all were welcome and had a good time,” Dave DesRoches, an assistant professor at the National Defense University in Washington, DC, told The New Arab.

“The Qataris were rooting for the Saudis just as they were later all rallying around Morocco. There’s a reservoir of goodwill that [is] combined with the political [understanding that Saudi Arabia] will…treat [Qataris and others in the GCC] more as partners and less as subordinate states. I think that relations are going to improve,” added DesRoches.

“The Saudi leadership is aware of the value of soft power, status, and prestige. They have this…festival in Riyadh with DJ Khaled. They want to be a cool place. They realize that you can’t do that if you’re always complaining about everyone else. You got to do your own thing. I think the Saudis learned a lesson and relations with Qatar will be a lot better.”

Caroline Rose, a senior analyst and head of the Power Vacuums programme at the New Lines Institute for Strategy and Policy, told TNA that “following some of the bridge-building efforts we witnessed during the World Cup, we will see some Saudi efforts to extend an olive branch towards Qatar and continued efforts to coordinate over economic matters and tourism sectors”.

Dr Aziz Aziz Alghashian, a fellow at the Arab Gulf States Institute in Washington, shared a similar view in an interview with TNA. “2022 will end on a high note regarding Saudi-Qatari relations. The symbolic gestures towards one another during the World Cup suggests that Saudi-Qatari relations will continue to develop, with less caution than before - caution will always be there, but it is less,” he said.

|

|

“I also think that there is more caution when it comes to Qatari-UAE relations. I don’t see a great UAE-Qatari spat on the horizon, but rather, a careful inorganic rapprochement that is propelled by regional elements rather than a bilateral one,” Alghashian added.

Speaking to TNA, Dr Ali Bakir, a professor at Qatar University and a non-resident senior fellow at the Atlantic Council, stressed that “business, diplomacy, and soft power” are the main interests of the GCC’s primary players. Though he cautioned against ruling out the possibility of surprises.

“Trends and indicators within the GCC are not so indicative given how these Arab Gulf countries generally operate and how the decisions are highly personal. In 2023, we might see Saudi-Qatari relations advancing, while the competition between Saudi Arabia and the UAE on certain issues is heating up. Oman will try to utilise its unique position and role to benefit from as much business ties and opportunities as possible from both Riyadh and Abu Dhabi,” added Dr Bakir.

He expects Bahrain’s role in GCC dynamics to remain “marginal” in 2023 while “Kuwait is always expected to focus on mediation efforts and humanitarian diplomacy in its foreign policy” and Qatar is likely set to “continue to focus on mega soft power producing events as a part of its soft power diplomacy and culture, probably with an eye this time on hosting the 2036 Summer Olympic Games”.

"This overall warming of relations among countries in the GCC family is set to continue, both at state-to-state and people-to-people levels"

Yemen

From a security standpoint, the evolution of the “no war, yet still no peace” limbo in Yemen will be important to the GCC members. There is little reason to expect 2023 to be anything other than an extremely challenging year for Yemenis while experts believe that the prospects for significant progress toward peace are dim.

Some analysts have concluded that partitioning the country along North-South lines - effectively giving up on hopes for the 1990 reunification of the country - is the only realistic way to bring lasting peace to Yemen even if partition comes with countless challenges and has highly problematic aspects.

“The Houthis will likely remain dominant, while the internationally-recognized government will fail to increase its unity and therefore build a stronger anti-Houthi front,” explained Dr Thomas Juneau, an associate professor at the University of Ottawa’s Graduate School of Public and International Affairs and a non-resident fellow with the Sana'a Center for Strategic Studies, in an interview with TNA.

“In this context, Saudi Arabia will increasingly feel the strain of its costly intervention that will be entering its ninth year in March 2023.”

It will be critical to see how the Saudis and Emiratis deal with their conflicting interests vis-à-vis Yemen, especially if the factions that Riyadh and Abu Dhabi sponsor engage in more fighting against each other in 2023. Thus far, Saudi Arabia and the UAE have mostly succeeded in managing their disagreements in Yemen. Yet, this will probably remain a source of friction in bilateral relations next year.

Furthermore, how the Houthis leverage their position of relative strength will be important to monitor in 2023. “The truce in Yemen was not renewed in October 2022, yet the Houthis and the internationally recognized [government] have mostly respected it so far. That said, the Houthis have used this relative calm to consolidate and regroup; as the government remains weak and fragmented, the Houthis' relative power is likely to improve in 2023,” explained Dr Juneau.

“They could therefore be tempted, at some point, to launch a new offensive, perhaps in Marib in the centre of the country. Should Marib fall, government forces would suffer a major blow. This would put significant pressure on Saudi Arabia and the UAE, yet their hands are tied: if they attempt to push back hard against the Houthis, the latter will most likely attack them with missiles and drones. From this point, the situation could escalate – or result in an embarrassing retreat for Riyadh or Abu Dhabi,” added Dr Juneau.

|

|

Abraham Accords

The Arab region’s overall trend toward normalisation with Israel will be important to monitor in 2023. It remains to be seen whether the Biden administration can successfully play its cards to facilitate the entry of more Arab-Muslim countries into the Abraham Accords - a defining legacy of the Trump administration’s Middle East foreign policy that team Biden seeks to build on.

Mindful of the extremist nature of Israel’s incoming government, analysts will need to keep a close eye on how Arab states in the Abraham Accords deal with the far-right elements at the helm of Benjamin Netanyahu’s government.

This is particularly so if tensions regarding al-Aqsa mosque heat up or if there is a massive amount of bloodshed in Gaza and/or the West Bank. Countries such as the UAE and Bahrain have their own interests vis-à-vis Israel which are unrelated to the Palestinians.

"The Arab region's overall trend toward normalisation with Israel will be important to monitor in 2023"

Yet, domestic and regional pressures could come down on officials in Abu Dhabi and Manama to reassess some of their approaches to the Abraham Accords depending on how developments unfold in 2023.

“We’re going to see if the Abraham Accords have any real impetus to them,” DesRoches told TNA. “The Biden administration has been somewhat muted on [the Abraham Accords] to the point that many Republicans felt they were trying to stifle it, as some type of active oblivion against the Trump administration,” he added.

“But we’re still trying to see whether this is a true fundamental alignment or a transactional thing, if Netanyahu annexes more land around Jerusalem, and if the Abraham Accords will implode, that’s something everyone’s going to look at closely.”

Ukraine conflict and food insecurity

The Russian invasion of Ukraine on 24 February was a major game-changer in global affairs with reverberations felt across the Middle East. Amid a period of accelerated East-West bifurcation, GCC states have, to their credit, managed to balance their deep relationships with NATO members and Moscow without having to ‘pick a side’ in this conflict.

Yet, with the conflict in Ukraine appearing nowhere close to any peaceful resolution, Gulf Arab governments will continue to face challenges in terms of navigating the direct and indirect effects of this war.

The absence of any end game in Ukraine is unsettling. Kyiv wants all Russians out and Moscow demands that Ukraine give Russia roughly one-fifth of the territory in its internationally recognised borders. Against this backdrop, the potential for this war to involve nuclear weapons is beyond disturbing, to say the least.

“A conventional war that escalates to a nuclear war would be a catastrophe for the world. For the Gulf region, the absence of an end game in Ukraine and an expected rise in Chinese demand for energy with the apparent end of zero COVID means oil will remain an irritant in relations with the United States,” said Ferial Ara Saeed, a former US State Department official and a non-resident senior fellow with the Scowcroft Strategy Initiative in the Atlantic Council’s Scowcroft Center for Strategy and Security, in an interview with TNA.

|

|

“Furthermore, all the global problems exacerbated by the war – famine, skyrocketing food and energy prices, rising debt – could get worse. That is a big headwind for the global economy,” explained Saeed.

“Right now, of course, the big thing that the Gulf needs in the security realm quickly is for Saudi Arabia to replenish its inventory of Patriot PAC-2 missiles,” DesRoches told TNA. “The US only makes like a couple hundred of those a year at best, and Saudi Arabia needs several hundred. If [the Americans] provide it to Ukraine, how’s that going to break out between Ukraine and Saudi Arabia? They both have immediate needs for them. Meanwhile, North Korea is firing missiles again too. So, we’re going to see those immediate impacts.”

The global food security stakes are extremely high for GCC states mindful of how much spikes in food prices can impact regional and international stability. The situation in Egypt must be closely monitored given how much Gulf Arab countries have vested interests in the political stability of the Cairo regime. Beyond Egypt, other Arab/African countries such as Lebanon, Jordan, Somalia, and Sudan face serious food security challenges that could require GCC states to help them address.

“You could make a persuasive case that the 2008 global food price spike was a contributing or causal factor for political instability in Syria, Libya, and Tunisia,” said DesRoches. “So, we haven’t seen that yet, but we will. My fear is that we’ll see it toward the end of 2023.”

"The global food security stakes are extremely high for GCC states mindful of how much spikes in food prices can impact regional and international stability"

Iran

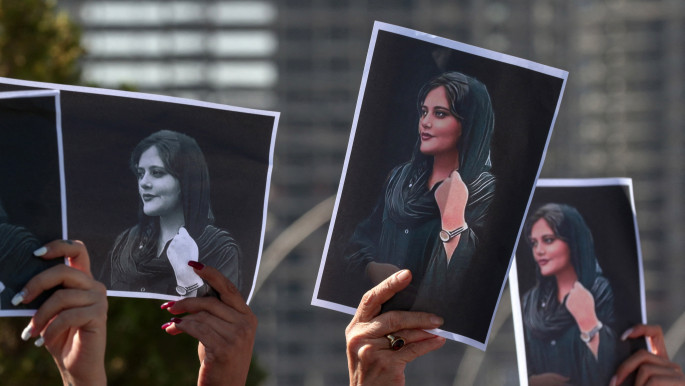

The death of Mahsa ‘Jina’ Amini while in the custody of Iran’s “morality police” in mid-September set off nationwide protests that represent an enormous challenge to the Islamic Republic’s legitimacy.

Although one could argue that no single Arab state has any interest in seeing the Iranian state collapse, the GCC’s anti-Iran hawks - Saudi Arabia, the UAE, and Bahrain - see the unrest across their Persian neighbour as perhaps beneficial in the sense that the leadership in Tehran might have to spend much of, if not all of, 2023 diverting resources away from regional adventures toward domestic efforts to quell the protests.

The GCC states which have opposed the Joint Comprehensive Plan of Action (JCPOA) are also content to see Western statesmen move further away from any willingness to negotiate a revival of the 2015 nuclear deal.

“The Arab states of the Gulf are watching the protests in Iran with a mixture of hope and dread,” Dr Juneau told TNA. “On the one hand, it is clear that the Islamic Republic’s domestic troubles weaken their main adversary, a prospect they welcome. On the other hand, the protests put them in an awkward position,” he added.

“Any grassroots popular movement that seeks to overthrow a dictatorship poses a threat. In addition, the scenario of the collapse of the Islamic Republic - far-fetched only a few months ago, but by now conceivable, even if not imminent - raises the spectre of long-term unrest right across the Persian Gulf, [which is] also a worrying scenario.”

As 2022 winds down, it is critical to ask what is in store for diplomatic relations between GCC members and Iran next year. Throughout this past year, Iran and three GCC states - Kuwait, Saudi Arabia, and the UAE - improved their relationships through dialogue and the return of the Kuwaiti and Emirati ambassadors to Tehran.

However, in the case of Iranian-Saudi relations, the ongoing unrest in Iran and the Islamic Republic’s belief that Riyadh has been fomenting much of it via Saudi-funded Persian networks like Iran International have led to a freezing of bilateral talks. “I think that as protests have swept Iran and have incentivised Tehran to crack down and blame external forces, it’s possible that some of the rapprochement efforts - however limited they may be - could be reversed,” warned Rose.

What is concerning for GCC states is the possibility of Iran lashing out in the region more forcefully as a means of distracting its own population from domestic problems while attempting to divide the opposition and rally more Iranians behind the flag. “In my opinion, the biggest danger GCC states face is the current situation in Iran,” Alghashian told TNA. “The domestic turbulence might induce a serious of irrational deflecting tactics against GCC states in the hope of alleviating pressure from protesters.”

DesRoches has similar concerns about Tehran’s efforts to further internationalise domestic strife to discredit opposition elements as foreign agents, underscored by the launching of Iranian missiles into northern Iraq.

|

|

“The protests look as though they’ll go on. But they don’t look like they’ll reach a culmination point because there’s still not a united opposition and there’s not a charismatic leader…How does the regime deal with protests? They basically attack outside, and they try to discredit these guys as agents of the ‘Zionist entity’. We might see Iran be more willing to strike out as a means of dealing with this internal dissatisfaction…Its missiles get better and more accurate as time goes by,” observed DesRoches.

Not lost in the equation are changes in Iraq’s political arena and their wider regional implications. With a new prime minister in Baghdad who is under greater Iranian influence than his predecessor was, Iraq has less potential to serve as a credible diplomatic bridge between the GCC’s anti-Iran states and Tehran.

Yemen’s tenuous situation is relevant too. As Rose explained, the collapse of the truce in early October “also throws a wrench into some of the positive trends we have seen that have inched the region closer to relative security.” Indeed, there are concerns about how Tehran could take advantage of the post-truce environment in Yemen to put more pressure on Saudi Arabia, the UAE, and Western powers to make concessions to the Islamic Republic.

"The Arab states of the Gulf are watching the protests in Iran with a mixture of hope and dread"

If tensions between Saudi Arabia and the UAE on one side and Iran on the other exacerbate in 2023, it will be important to see what Qatar could possibly do to try to ease such friction.

The improvements in Riyadh and Abu Dhabi’s relationship with Doha, whose ties with Iran deepened amid the 2017-21 GCC crisis, could possibly position Qatar to play a middle-man role next year between Gulf Arab states and the Islamic Republic in ways that would bode positively for regional security.

“There is no stable regional order without Iran, and Iran is now on a path to becoming a bigger threat. If Qatar can help mitigate that threat, that’s a role worth developing,” Saeed told TNA.

Giorgio Cafiero is the CEO of Gulf State Analytics. Follow him on Twitter: @GiorgioCafiero

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News