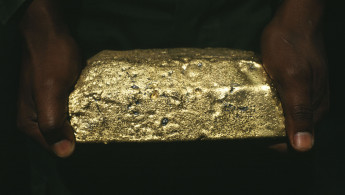

Gulf companies investing in Sudanese gold despite 'war-crimes links'

A number of Gulf businesses are looking to increase imports of gold from Sudan, despite plentiful evidence that the industry is directly linked to war-crimes and the country’s ongoing humanitarian disaster.

Sudan’s Minister of Minerals, Ahmed Sadiq al-Karouri, told visiting dignitaries and investors that there was no prospect of international sanctions on Sudan’s gold exports and that the country aimed to increase gold production by 30 tons a year.

"All the mining companies working in Sudan are able to export their gold production without any restrictions," Karouri said.

A recent report by the Enough Project found that gold mining and mineral extraction in the country was directly responsible for war crimes in the country’s south.

"Gold coming from Sudan is conflict-affected, high-risk, and helping to destabilise Darfur, Blue Nile, and South Kordofan, the country’s main conflict zones," the report said.

"In those areas, civilians living around gold mining sites have suffered killings, mass rape, and the torching of their homes and fields at the hands of armed groups."

Saif bin Ali al-Salhi, president of the Oman-Sudan Investment and Development Council said: "We are excited to invest in Sudan's mineral sector and access to positive results in the near future."

Investors from Qatar, UAE and Saudi Arabia also signalled their interest in investing in Sudanese gold during a visit to the country this August.

Another important investor in the Sudanese gold market is Russia, who recently signed an agreement to invest in the country’s gold mining sector.

Karouri met with Russian foreign minister, Sergey Lavrov, on 13 October to sign an agreement on Russian investment in Sudan’s mineral extraction industries.

"The agreement with Russian Geology Company includes the development of minerals and geological laboratories," Karouri said.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News