After Soleimani's assassination, Iran's behaviour will determine the global oil price game

Oil prices surged when the US assassination of Iran's most celebrated military leader ignited fears of Iranian retaliation that could threaten global supply.

Prices are likely to stabilise as Iran decides how to retaliate, and when. But make no mistake: It will act sooner or later.

At the moment it is unlikely to be soon because Tehran is benefiting politically from condemnation of the attacks by kingpins in America's Democratic Party, a lot of European leaders, plus Russia and China.

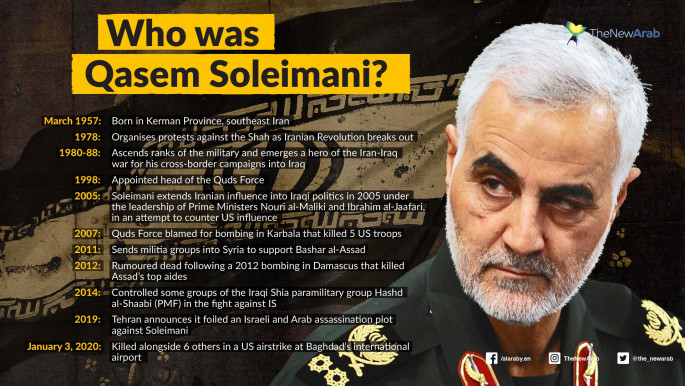

Four hours after American drones killed General Qasem Soleimani, the head of Iran's Islamic Revolutionary Guard Corps, near Baghdad airport, oil prices had jumped more than three percent.

This continued a surge that started when pro-Iranian militias killed an American military contractor in Iraq, the US retaliated by taking out several militia leaders in airstrikes, and militia members stormed the American Embassy in Baghdad twice in two days.

Also igniting prices were expectations of an imminent agreement to end the US-China trade war.

Meanwhile, there is talk that the United States has shot itself in the foot with the assassination. US President Donald Trump doesn't want skyrocketing gasoline prices as he seeks re-election. The thinking is that if oil prices continue to soar, he is in trouble with voters. Therefore, the United States will urge immediate de-escalation, while asking its allies to do the same.

|

|

| Read also: The significance of Qasem Soleimani's assassination |

The oil price spurt reflected buyers snapping up crude supplies before a possible crunch. Purchasers have reason to be concerned about Iran retaliating against the United States with a strategy that reduces supply: It has done it before.

Iran not only damaged oil tankers, but also allegedly shut down five percent of the world's crude production with a drone attack on its arch-enemy Saudi Arabia's largest oil field.

The history of Iran's oil-related political retaliation indicates it will take its time retaliating. This will allow it to continue milking international condemnation against the US assassination, which has come from American friends and foes alike.

Many European countries are already upset with the Trump administration scrapping the Iran nuclear deal that the Obama administration negotiated and believe that isolating Tehran again would be counter-productive to peace in the Middle East and beyond.

|

Four hours after American drones killed General Qasem Soleimani, the head of Iran's Islamic Revolutionary Guard Corps, near Baghdad airport, oil prices had jumped more than 3% |  |

That isolation, including new US economic sanctions that have hammered Iran's economy, has sparked domestic turmoil in Iran that has already angered Tehran's leaders.

If Iran immediately resorted to force to disrupt global oil supplies, much of the international community would turn against it. So in the short term it will use diplomacy to push the narrative that the US attacks on the Iraqi militia leaders and Soleimani were illegitimate.

Russia, which shares Iran's objective of reducing Washington's influence in the Middle East, responded to the assassination news by poking Washington in the eye with a sharp stick.

It praised Soleimani's fight against the Islamic State group [IS] and other terrorist organisations in Iraq and Syria, while calling the attacks on the Iraqi militias and Soleimani "unconsidered" and "adventurist."

|

|

The Trump administration must have considered the possibility that the assassination would trigger an oil price surge, but decided that other factors outweighed the risk.

American officials contend that Soleimani has orchestrated attacks that have killed many American service people in Iraq and Syria, and planned more. They may have decided that enough was enough.

In considering whether to take out Soleimani, Washington likely believed it could count on its ally Saudi Arabia, which leads the OPEC+ cartel, to keep oil prices in check. It also knew it could flood the global market with oil from its Strategic Petroleum Reserves to prevent prices from skyrocketing over the short term.

Given Trump's propensity to shoot first and think later, US officials may have failed to give enough weight to the long-term consequences of the assassination, however.

One consequence is likely to be a deeper rift between the United States and its NATO allies, many of whom believe that the Trump administration has been disastrous for the transatlantic alliance.

European leaders were almost unanimous in perceiving the Iran nuclear agreement that Barack Obama forged as a good deal, reducing the threat of a conflagration in the Middle East that could envelop Europe and the world.

In addition to being upset about Trump abandoning the nuclear agreement, they are upset with his constant questioning of NATO's worth and his cozying up to Russian leader Vladimir Putin. They have been particularly critical of Trump's re-imposition of economic sanctions against Iran, maintaining that they will make the country more dangerous and hurt rank-and-file Iranians rather than its leaders.

While the United States is likely to be the major loser from the assassination, its enemies Russia and China are likely to be big winners. Moscow and Beijing have already condemned the militia attacks and the Soleimani assassination, a stance that will gain them many friends in the Middle East and the rest of the world.

Rauf Mammadov is resident scholar on energy policy at The Middle East Institute and senior adviser at the Gulf State Analytics. He focuses on issues of energy security, global energy industry trends, as well as energy relations between the Middle East, Central Asia and South Caucasus.

Follow him on Twitter: @RaufNMammadov

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News