Gulf countries to go into the red in 2016?

Resource-rich Qatar has become the latest Gulf state to predict a budget deficit for 2016.

This is Qatar's first projected budget deficit in 15 years, according to official government figures.

Figures released by Doha's ministry of development, planning and statistics have shown the economy of the tiny state - which is about half the size of Wales - is predicted to grow by 7.3 percent in 2016, down from a previous official estimate of 7.7 percent.

As a result, Qatar expects to run a 2016 deficit of 4.9 percent of GDP, the ministry said, and 3.7 percent in 2017.

Qatar and Kuwait were expected to run surpluses in 2015, however both now look set to record deficits along with other Gulf countries.

Low oil prices

Despite these financial woes, Doha insists it will push on with huge infrastructure projects ahead of the 2022 football World Cup.

"The fall in oil prices that began in June 2014 was not anticipated," said Saleh al-Nabit, development, planning and statistics minister.

|

|

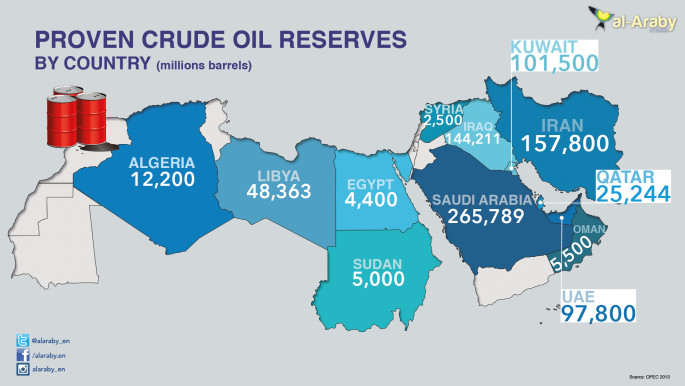

| Oil reserves in the Middle East [click to enlarge] |

"If they persist, lower oil prices will narrow the government's fiscal cushion - but our considerable financial reserves will provide an ample buffer... important capital spending plans will proceed."

Doha is expected to spend some $200 billion on infrastructure projects over the next decade, including a metro system and construction of a new city, north of Doha.

Gulf swing

Saudi Arabia is also expected to post a budget deficit of 20 percent of GDP in 2015.

"Government spending in 2015 is expected to remain strong, partly due to a number of one-off factors, while oil revenues have declined," an International Monetary Fund team said after visiting the Gulf kingdom.

"As a result, IMF staff projects that the government will run a fiscal deficit of around 20 percent of GDP in 2015."

The projected deficit translates into around $130 billion, as the IMF is projecting Saudi nominal GDP this year at $649 billion.

| The IMF projects the Saudi government will run a fiscal deficit of around 20 percent of GDP in 2015. |

Defence spending

Despite this, Saudi Arabia has pushed on with huge defence spending, and continuing its war on the Houthis in Yemen.

Saudi Arabia is now the third-largest defence spender in the world, and world's largest arms importer.

The war in Yemen is also likely to have a negative effect on Riyadh's coffers.

According to AFP, Saudi firm Jadwa Research said the kingdom's foreign reserves dropped by $49 billion in the first four months of 2015, following the dive in world oil prices.

In March and April alone, the reserves dipped $31 billion, it added.

Low oil prices have also caused losses for other Gulf nations. In June 2014, oil prices plummeted to just $46 a barrel from $115.

Although prices have begun to stabilise at around $65 it is still below the "break-even" price for many Gulf states.

In its regional economic outlook last month, the IMF estimated the oil price necessary to balance the Saudi budget at more than $100 a barrel. Countries with smaller oil reserves - such as Oman and Bahrain - need oil prices to be even higher.

In May, the IMF urged Gulf nations to reduce spending to help balance the books.

This includes ending costly subsidies to citizens, something that Bahrain has begun and Oman is reportedly considering.

Despite an oil glut, Opec nations agreed earlier this week to keep oil production levels at the same levels.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News