Egypt to receive $12 billion loan from IMF

The Egyptian government hopes the three-year deal will provide a lifeline for the North African nation as it grapples with a dollar shortage and dwindling foreign reserves.

Cairo will be required under the agreement to undertake economic reforms to alleviate the demand for black market dollar trading, bring down the budget deficit and government debt, as well as raise growth and create jobs.

"Egypt is a strong country with great potential but it has some problems that need to be fixed urgently," the head of the IMF delegation to Egypt, Chris Jarvis, said in a statement.

The IMF was looking to Egypt's parliament to pass a law introducing a value-added tax, the statement said, adding that the planned government measures include tax increases and cuts in energy subsidies.

Egypt earlier this week already announced it would raise electricity prices by a least a quarter, a jump forward in its plans to eliminate the subsidies altogether by 2019.

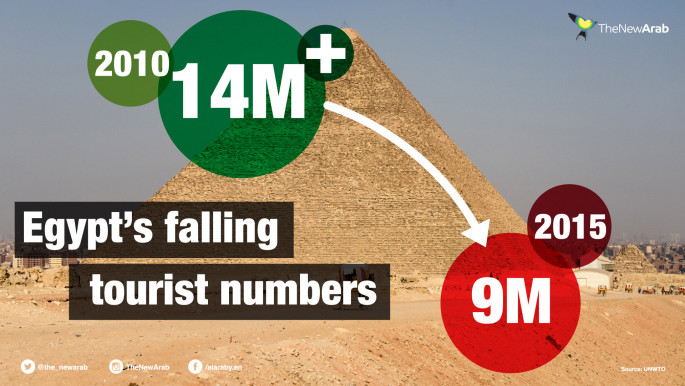

Egypt's economy has been struggling since the 2011 uprising that overthrew long-time autocrat Hosni Mubarak, with high inflation, foreign currency shortages, and lack of tourism and investment that has hit both business and the broader population's well-being.

|

| [Click to enlarge] |

The IMF's Extended Fund Facility is aimed at countries with payment imbalances and tepid growth to aid structural reforms, according to the fund's website.

Analysts have said the IMF also pushed for a more flexible exchange rate for the Egyptian pound, which the government has been propping up amid capital controls.

The dollar shortage has affected imports and created a flourishing black market trade that the government fought unsuccessfully.

Dollars sell for up to four pounds more than the official rate of 8.88 pounds to the dollar.

Jarvis said the goal was to have no foreign currency shortage and to create a "balance between supply and demand."

"The central bank is progressing on exchange rate policy, the government has its programme, the budget was approved in June, the VAT is in parliament... the government's fuel subsidy reform program continues to unfold," Jarvis said.

Central Bank of Egypt chief Tarek Amer told reporters that the IMF deal would boost confidence in Egypt's reform programme.

The deal "is a certificate that says the programme is serious," he said at the press conference.

"We ask citizens to have trust and stand behind us," he added.

President Abdel Fattah al-Sisi has been preparing public opinion for the economic reform measures, including further subsidy cuts.

Although the funding is spread out over three years, the IMF will be looking for a quick implementation of the reform measures.

"The IMF would like to see change right now, not delayed," said Angus Blair, president of the economic think tank Signet.

Egypt has been in tentative negotiations for an IMF loan since the 2011 revolution.

The uprising set off years of political turmoil culminating in the military overthrow of his Islamist successor Mohamed Morsi two years later.

Morsi's removal unleashed a bloody police crackdown on Islamists and jihadist attacks that have decimated tourism, a key dollar earner for Egypt.

With tourist revenues and foreign remittances down, the country's foreign reserves have fallen to $15.5 billion [13.9 billion euros].

Egypt has already received more than $20 billion in aid from Gulf countries that supported Morsi's overthrow, but that has not stemmed the decline.

Critics say the reform programme should have been staggered over the past years, to dampen any shock.

Agencies contributed to this report

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News

![The UAE is widely suspected of arming the RSF militia [Getty]](/sites/default/files/styles/image_330x185/public/2024-11/GettyImages-472529908.jpg?h=69f2b9d0&itok=Yauw3YTG)

![Netanyahu furiously denounced the ICC [Getty]](/sites/default/files/styles/image_330x185/public/2024-11/GettyImages-2169352575.jpg?h=199d8c1f&itok=-vRiruf5)

![Both Hamas and the Palestinian Authority welcomed the ICC arrest warrants [Getty]](/sites/default/files/styles/image_330x185/public/2024-11/GettyImages-2178351173.jpg?h=199d8c1f&itok=TV858iVg)