Egypt asks for $12-billion loan as economy nears collapse

Egypt is in the "final stages" of negotiating an agreement with the International Monetary Fund to secure a $12 billion loan over three years, while targeting more loans totalling $7 billion annually.

President Abd al-Fattah al-Sisi held a Cabinet meeting on Wednesday to discuss economic developments, including the IMF loan, according to a statement.

Amr al-Garhy, the finance minister, told local media on Tuesday that Egypt is discussing a total of $12 billion from the IMF.

He added that the first payment of the IMF loan would arrive within three months.

IMF Middle East and Central Asia director Masood Ahmed said in a statement that an IMF delegation will start a two-week visit to Egypt on July 30 to continue the talks.

"The Egyptian authorities have asked the IMF to provide financial support for their economic program. We welcome this request, and look forward to discussing policies which can help Egypt meet its economic challenges,"

Our goals are to help Egypt return to economic stability and to support strong, sustainable and job-rich growth," it said.

|

|

| The Egyptian pound has fallen to new lows [Getty] |

Presidential spokesman Alaa Youssef told reporters that the meeting is aimed at finding the necessary financial sources to help stabilise the Egyptian economy.

Years of unrest since the 2011 overthrow of longtime autocrat Hosni Mubarak have taken a heavy toll on both foreign investment and tourism, which along with Suez Canal revenues and remittances from Egyptians working abroad are the primary sources of foreign currency.

Reserves fell 18.1 percent from June to December, shrinking to $16.5 billion, before edging up to $17.546 at the end of June, according to central bank data.

Egypt had $36 billion in reserves before the 2011 uprising.

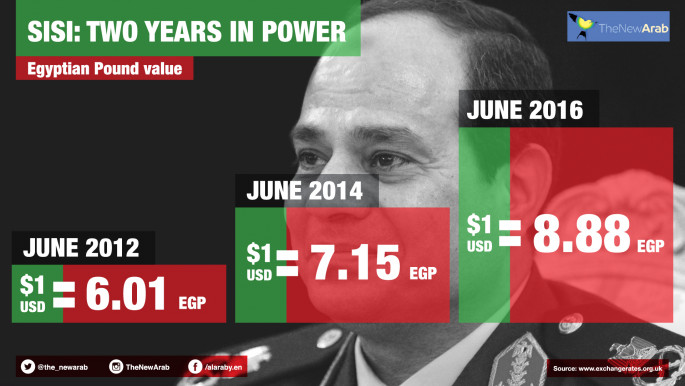

Egypt's local currency has been falling to new lows; the official central bank rate is 8.78 Egyptian pounds to the dollar, but the true price on Egypt's robust black market, according to media reports, is close to 13 to the dollar.

|

|

| [Click to enlarge] |

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News

![Israeli forces ordered bombed Gaza's Jabalia, ordering residents to leave [Getty]](/sites/default/files/styles/image_330x185/public/2176418030.jpeg?h=a5f2f23a&itok=_YGZaP1z)