Bahrain and Oman get credit downgrade

Credit Agency Moody's has lowered the credit ratings of two of the Gulf region's smallest oil producers, Oman and Bahrain.

Bahrain's rating was lowered one notch to Ba1, which is seen as carrying significant credit risk.

Meanwhile, Oman's rating was lowered two notches to A1, which is still an upper-medium grade with low credit risk.

"[These cuts] reflect the impact of the continued large fall in oil prices," the ratings agency said in a statement.

This has impacted heavily on Bahrain and Oman, which are less revenue or resource rich than their Gulf neighbours.

Lost revenues

Low oil prices cost Oman $14 billion in lost revenues last year.

But the situation wasn't good for the remaining Gulf oil exporters who are on review for a downgrade.

Moody's review covers Opec's powerhouse Saudi Arabia, whose rating Standard and Poor's cut two notches to A- last month, the United Arab Emirates, Kuwait and Qatar.

"Despite low oil prices and a high dependency on oil revenue across the GCC countries, banks' ratings in the region continue to benefit from their government’s willingness to tap accumulated wealth to support counter-cyclical spending," the report read.

"But continued oil price declines signal increasing challenges to the sustainability of this dynamic."

Moody's has forecast oil prices to average $33 a barrel in 2016, $38 a barrel next year and $48 a barrel by 2019.

This could have the biggest impacts on Bahrain and Oman.

Bahrain is a relatively small exporter, but oil and gas accounted for 75 percent of its exports and 86 percent of public revenues between 2010 and 2014, Moody's said.

|

All GCC states have undertaken austerity measures including cuts to subsidies to counter financial surpluses but this may not be enough. |  |

Oil and gas income also made up 90 percent of the Omani government revenues.

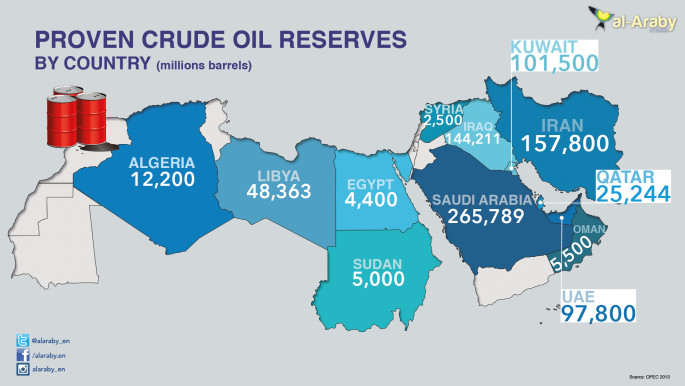

Reserves

The sultanate has much lower financial reserves than its wealthier GCC partners, with government financial assets amounting to only about three years of spending, the agency said.

|

| [Click to enlarge] |

Moody's said the structural shock set off in the oil market is weakening Gulf states' balance sheets, their economies and therefore their credit profile.

Oil accounts for 84 percent of Saudi Arabia's exports, 40 percent of GDP and 62 percent of consolidated government revenues. Before the oil price drop, the crude income contribution was around 90 percent.

All GCC states have undertaken austerity measures including cuts to subsidies to counter financial surpluses but this may not be enough, the credit rating agency said.

Oman also rolled out a number of cuts to expenses for government workers, although the savings again are thought to be minimal.

Moody's said last month that fuel subsidy reforms will help reduce pressure on budgets but are not enough to offset deficits resulting from low oil prices.

Government spending on infrastructure projects have also been a key area in growth for non-oil and gas industries for Oman and Bahrain. Some of these larger plans could be cut now that coffers are beginning to run dry.

Gulf states also have generous but expensive welfare systems for its citizens but these are coming under review - particularly in Oman and Bahrain - with low oil prices set to continue.

They also used their financial reserves to roll out further financial benefits and job creation during the Arab Spring, which helped them weather the storm of regional unrest.

Agencies contributed to this story.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News