'Historic' OPEC deal allows Iran to boost oil production

Despite overall cut to cartel's output, Iran will be allowed to increase its oil output by 90,000 barrels per day.

3 min read

Iraq is among the OPEC members who have agreed to cut production [Getty]

The Organisation of Petroleum Exporting Countries has agreed to cut production of oil in a bid to rescue tanking prices.

The producers' cartel will reduce production by 1.2 million barrels per day – around one percent of global production – to help reduce the glut in the market and restore prices.

Saudi Arabia – which, along with other resource-wealthy Gulf nations, has been facing "austerity measures" to cope with drastically reduced revenues – has agreed to cut production by the largest amount and will pump some 486,000 fewer barrels per day than current levels when the agreement comes into force in January 2017.

Riyadh's main geopolitical rival, Iran, however, is to be allowed to increase production by 90,000 barrels per day – the only OPEC member to boost production under the deal.

"We took into consideration that some countries needed special consideration, so we did that with unanimous agreement," said OPEC president Mohammed bin Saleh al-Sada, also Qatar's energy minister.

"My colleagues think this is an historic agreement... to reduce stock overhang."

It is the first time the group has come to agreement over cutting production since 2008.

Al-Sada said the election of Donald Trump had not weighed heavily on discussions to "re-balance the market".

"We considered market conditions and did not specualte over individual country's policies," he said.

Oil trading was frenetic throughout Wednesday, as traders speculated on the potential ramifications of a deal. The Saudi Tadawul Share Index crossed the 7,000 mark, as petrochemical and infrastructure stocks rallied.

The price of Brent Crude jumped 8.8 percent on the announcement, reaching the landmark price of $50 a barrel for the first time since late October – the biggest single-day rise in more than nine months.

Riyadh had previously insisted that Tehran join in any production cut, but a breakthrough was made during Wednesday's meeting, with Iran reportedly playing up regional neighbourliness with Saudi Arabia.

"We should cooperate, we need each other to manage the market," Iran's oil minister Binjan Zangeneh was reported as saying. "OPEC is not a battlefield."

OPEC has agreed to establish a monitoring committee of Algeria, Kuwait and Venezuela, along with two non-OPEC countries, to keep an eye on the six-month deal – which may be renewed for a further six months at their next summit.

The whole deal, however, is contingent on non-OPEC oil producers also cutting production by 600,000 barrels per day.

OPEC officials say they have had assurances from Russia that it will cut production by 300,000 bpd, but it remains to be seen if elsewhere – particularly in the West, how effective government officials will be in ordering private corporations to reduce output.

Other criticism levelled at the deal includes the fact that Indonesia has today suspended its membership of the cartel, so the remaining members have simply shared out its production quota between themselves, meaning they have had to cut less than may otherwise have been expected.

Reaching a deal is hard enough. Its implementation and enforcing the adherence of sovereign states will likely be much harder.

Follow James Brownsell on Twitter: @JamesBrownsell

The producers' cartel will reduce production by 1.2 million barrels per day – around one percent of global production – to help reduce the glut in the market and restore prices.

Saudi Arabia – which, along with other resource-wealthy Gulf nations, has been facing "austerity measures" to cope with drastically reduced revenues – has agreed to cut production by the largest amount and will pump some 486,000 fewer barrels per day than current levels when the agreement comes into force in January 2017.

Riyadh's main geopolitical rival, Iran, however, is to be allowed to increase production by 90,000 barrels per day – the only OPEC member to boost production under the deal.

"We took into consideration that some countries needed special consideration, so we did that with unanimous agreement," said OPEC president Mohammed bin Saleh al-Sada, also Qatar's energy minister.

"My colleagues think this is an historic agreement... to reduce stock overhang."

|

|

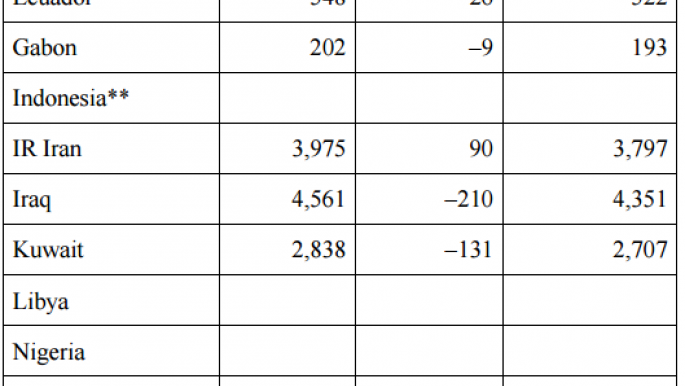

| Numbers shown are in hundreds of thousands of barrels produced per day Source: OPEC |

It is the first time the group has come to agreement over cutting production since 2008.

Al-Sada said the election of Donald Trump had not weighed heavily on discussions to "re-balance the market".

"We considered market conditions and did not specualte over individual country's policies," he said.

Oil trading was frenetic throughout Wednesday, as traders speculated on the potential ramifications of a deal. The Saudi Tadawul Share Index crossed the 7,000 mark, as petrochemical and infrastructure stocks rallied.

The price of Brent Crude jumped 8.8 percent on the announcement, reaching the landmark price of $50 a barrel for the first time since late October – the biggest single-day rise in more than nine months.

| Read more: Uncertainty in oil markets as OPEC decides future |

"We should cooperate, we need each other to manage the market," Iran's oil minister Binjan Zangeneh was reported as saying. "OPEC is not a battlefield."

OPEC has agreed to establish a monitoring committee of Algeria, Kuwait and Venezuela, along with two non-OPEC countries, to keep an eye on the six-month deal – which may be renewed for a further six months at their next summit.

|

OPEC is not a battlefield - Iran oil minister Bijan Zanganeh |

|

OPEC officials say they have had assurances from Russia that it will cut production by 300,000 bpd, but it remains to be seen if elsewhere – particularly in the West, how effective government officials will be in ordering private corporations to reduce output.

Other criticism levelled at the deal includes the fact that Indonesia has today suspended its membership of the cartel, so the remaining members have simply shared out its production quota between themselves, meaning they have had to cut less than may otherwise have been expected.

Reaching a deal is hard enough. Its implementation and enforcing the adherence of sovereign states will likely be much harder.

Follow James Brownsell on Twitter: @JamesBrownsell

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News

![The UAE is widely suspected of arming the RSF militia [Getty]](/sites/default/files/styles/image_330x185/public/2024-11/GettyImages-472529908.jpg?h=69f2b9d0&itok=Yauw3YTG)

![Netanyahu furiously denounced the ICC [Getty]](/sites/default/files/styles/image_330x185/public/2024-11/GettyImages-2169352575.jpg?h=199d8c1f&itok=-vRiruf5)

![Both Hamas and the Palestinian Authority welcomed the ICC arrest warrants [Getty]](/sites/default/files/styles/image_330x185/public/2024-11/GettyImages-2178351173.jpg?h=199d8c1f&itok=TV858iVg)