Saudi Aramco to publish finances for first time

Investors will have access to the accounts of the world's biggest oil producer ahead of its planned stock market launch in 2018.

The state-controlled oil company is also overhauling its reports to an industry-friendly format, four people close to the company told the Financial Times.

The planned listing of five percent of Aramco - which will transform the private firm to a publicly-owned company - could value the oil giant at more than $2 trillion toppling Apple as the world's largest listed company.

Although it issues production figures in its annual report, Aramco's financial statements have always been a closed book.

Investors will also gain access to backdated accounts for 2015 and 2016, which could be released as soon as next year, FT reported.

Its stock market offering - spearheaded by the kingdom's influential deputy crown prince Mohammed bin Salman - aims to reduce the state's reliance on oil, by using proceeds from the flotation to diversify the country's economy.

Recent cost-saving measures to counteract a steep drop in oil prices - crude prices more than halved to around $50 a barrel in the past two year - include slashing ministers' salaries and renegotiating up to $20 billion of contracts.

Budget pressures are thought to be behind Saudi Arabia's decision last week to agree to a cut in oil production, with Riyadh pursuing a higher price after two years of pumping more oil to win a bigger share of the market, which led to a global oversupply.

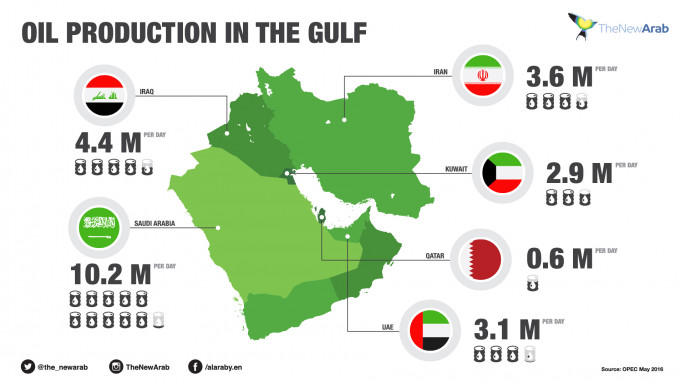

Analysts estimate that Saudi Aramco, which pumped 10.2 million barrels a day last year, generated higher revenues than Apple and Microsoft combined in 2014, before the oil crash.

But the company's performance has long been deemed a "black box" by the energy industry, due to its entanglement with the Saudi state, said FT.

Aramco is said to be organising its reporting in line with BP and ExxonMobil.

Tom Nelson, head of commodities and resources at Investec Asset Management told the FT: "There is a risk that the headline excitement will give way to an opaque and frustrating reality."

Saudi Aramco declined an FT request for a comment on its IPO plans or accusations that the company is opaque. "Saudi Aramco does not comment on rumour or speculation," said a company spokesman.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News