Libya's oil industry eyes comeback as fields reopen

During the unstable years that followed the ousting of former Libyan dictator Muammar al-Gaddafi in 2011, Libya's oil industry has also witnessed catastrophic damage.

But hopes for a breakthrough in the fortunes of Libya were raised earlier this month after years of false-dawns left the world's oil-markets reluctant to turn back to what was once a major oil-producing nation.

Oil-industry analysts spoke to The New Arab to tell of both their hope and scepticism about Libya's main export in light of political deals struck last month.

Before the popular uprising that removed long-ruling dictator in 2011, oil accounted for more than 95 percent of Libya's exports and over 75 percent of the Libyan government's annual budget.

But the fall of Gaddafi - which saw rebels backed by NATO airpower fight regime loyalists across the country - contributed to reducing Libya's capacity to produce and export oil.

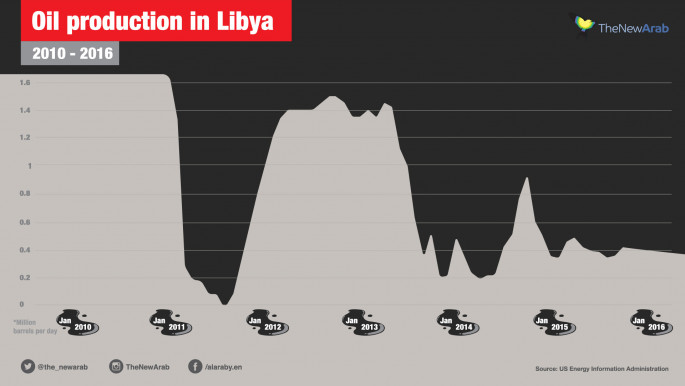

In the years that followed 2011, further fighting by rival Libyan factions and more recent attacks against oil-terminals by Libyan Islamic State group militants saw the country's exports drop from 1.5 million barrels per-day [bpd] at their height pre-2011 to around 350,000 in 2016.

|

| [Click to enlarge] |

The fortunes of Libya's beleaguered industry seem to have witnessed a positive turn around in recent months.

Earlier this month, Libya's UN-backed Tripoli government struck a deal with the country's Petroleum Facilities Guard [PFG] to reopen fields and pump crude again, who occupy the country's oil fields.

Politicians and bureaucrats agreed to reopen Libya's biggest export terminals Ras Lanuf, Es-Sider and Zueitina after months of closures.

Some analysts hailed the deal as a positive step, with many even predicting the country may double its oil production and flood an oversaturated market with tons of high-quality crude.

Others, however, feel the new plans may be too ambitious to realise while war rages in the country and IS control Sirte, a city on the Mediterranean coast while lies close to Libya's oil fields.

"We are unsure yet and we have to wait and see whether the deal will materialise," Guma El-Gamaty, head of Libya's Taghyeer Party and member of the UN-backed Libyan political dialogue process told The New Arab.

"Between 2011 and 2012, the Libyan daily export of oil stood at 1.6 million barrels per day after Libya had some problems with people occupying the oil ports," El-Gamaty said. "But as the war tore the country, oil production levels dropped drastically."

|

While Libya enjoys some of the largest oil fields in the continent, the five-year-old civil war has left its marks on the fields, pipelines and the port's infrastructure |  |

The result of this drop was catastrophic on the Libyan economy.

"Hard currency was lost and over the last two to three years, the country has been eating into its oil reserves," El-Gamaty said. "If this continues, Libya will be looking at borrowing money from banks, which will further weaken the Libyan currency."

While Libya has some of the largest oil fields in the African continent, the five-year civil war has left its mark on the fields, pipelines and the port's infrastructure.

"Even if the ports do reopen it is unclear how much oil will flow to them due to damages and continuing political complications," El-Gamaty told The New Arab.

|

| [Click to enlarge] |

"Libya's oil facilities suffered heavy damage from years of fighting and sabotage caused by militant groups," El-Gamaty said. "These need expensive repairs."

Meanwhile,the power struggle between an internationally-backed Tripoli government and a rival government in Tobruk may have limited effects on hopes for a breakthrough, as the oil industry is mostly controlled by an independent governing body, the National Oil Corporation [NOC].

"The NOC is the only institution responsible for oil production and export in Libya, and revenues go directly to the central bank. The NOC and Libya's central bank have the final word over matters relating to oil revenues," El-Gamaty said.

"The government will have to present a budget approved by parliament to the central bank who in turn will release funds to the government after review. The government that is being recognised here is Tripoli's Government of National Accord."

A meaningful return of high-quality Libyan crude to the oil market will stabilise the country's economy and could help heal some of the wounds from the fighting.

"If oil production resumes and grows anywhere near one million barrels a day within the next few weeks, it will boost confidence and stabilise the Libyan economy," El-Gamaty said.

However, if Libya pumps crude again it may find itself entering the OPEC price war amid a fragile and oversupplied oil market.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News