#PanamaPapers link Assad’s fixer to arms-dealers and money launderers

Marouf, the man the Western media calls Assad’s London fixer for his close links to the Assad regime and the Syrian president’s cousin Rami Makhlouf, appears to be a partner of Fouad al-Zayat, a Syrian arms dealer and money launderer known as the Fat Man; as well as a partner of close financial associates of Bashar al-Assad named in previous New Arab investigations (Part I and Part II).

The investigation shows how Marouf used offshore shell companies to dodge sanctions on Syrian regime associates in 2012 and carry on doing business as usual with his associates, even in the heart of Europe – including reportedly buying expensive jewellery on behalf of Assad’s wife Asma as women and children in Syria die from siege and starvation.

In March 2012, the Guardian published a series of leaked emails in which Asma placed orders with Marouf for goods worth thousands of pounds from Armani and Harrods.

The New Arab cross-examined documents leaked from the offshore consultancy Mossack Fonseca in Panama and the London-based HSBC bank with commercial registration data of a number of Syrian companies, to uncover the relationship between Marouf, Zayat and Assad’s financial circle and sanctions-busting network.

| Read More: Exclusive: The Assad family ties to Israeli business tycoon (Part 1) |

| Read More: All the dictator's men: Who runs Assad's sanctions-busting network? (Part 2) |

Marouf is a 44-year-old British citizen of Syrian origin living in London. He was previously named in WikiLeaks documents highlighting his correspondence with the Presidential Palace in Syria in 2012.

Marouf is one of three businessmen that independent analysts believe controls the Syrian economy, together alongside Mohammed Hamcho and Rami Makhlouf.

He owns (AR) dozens of companies, both in Syria and abroad and is involved in various sectors, from real estate and tourism to machinery and technology.

He is a partner of Bashar’s cousin and Syria’s "thief-in-chief” Rami Makhlouf in both the Syria Holding Company, and the Sham Holding Company, the largest company in Syria with a capital of over $360 million.

|

Marouf is one of three businessmen that independent analysts believe controls the Syrian economy, together alongside Mohammed Hamcho and Rami Makhlouf |  |

According to official EU sanctions announcement, Marouf is a support of the Syrian regime, a “businessman close to President Bashar al-Assad’s family.” He owns shares in the listed TV station Dounya TV and is close to Muhammad Nasif Khayrbik, who has been designated.

However, the EU lifted sanctions on Marouf in mid-2014 for “lack of evidence,” following a verdict from an EU appellate court, but kept sanctions in place against companies Marouf has shares in, such as Sham Holding and Dounya TV.

|

| Soulieman Marouf - TNA artist impression |

The offshore cloak

Following the start of the Syrian rebellion in 2011, Marouf closed down some of his companies, and renamed others in Damascus, London and other capitals where he is active. He even deleted the website of his main company Al-Shahba, all in an attempt to efface traces of his work, history, and links in anticipation of international sanctions.

However, official records in Syria, the Panama Papers and company records in Britain, accessible by the public, make it possible to uncover the real identity of these companies.

Documents issued by the British Virgin Islands through Mossack Fonseca establish Marouf as owner of a number of offshore companies sponsored by the Panamanian consultancy.

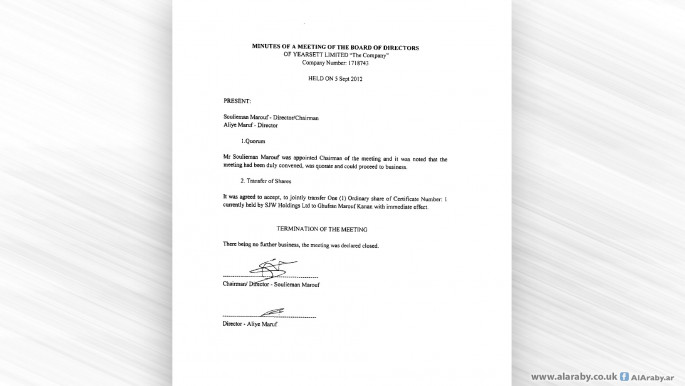

The companies Marouf co-owns and manages secretly include Gardania Enterprises Limited, funded in 2011; SJW Holdings, Kewside Limited and Forlan Assets Limited, established in 2012; and Oriental Trading and Industrial Company Limited and Riverville Development Limited, both real estate companies active in Britain, Europe and beyond since 2014.

Marouf is linked to other companies in the British Virgin Islands, including Yearsett Limited, Tatwoth Limited, Meriott Limited and Hallmount Limited, companies that own real estate, restaurant and night club projects in Britain and Europe.

These companies are linked to Marouf’s Syria-based company Al-Shahba.

According to the Organized Crime and Corruption Reporting Project (OCCRP), real estate is one of the most common channels for money laundering activities.

|

According to the Organized Crime and Corruption Reporting Project (OCCRP), real estate is one of the most common channels for money laundering activities |  |

All the President’s men

Previously unknown hidden offshore companies in which Marouf is involved can also be revealed by The New Arab through data on ten bank accounts at HSBC, including Woodbourne Corporation (BVI) LTD, R&H Trust Co. (BVI) LTD, Morgan Kenneth Wallace and Kegal Investments.

Following the so-called Swiss Leaks last year, the bank had to pay huge fines to the authorities in Geneva over its dubious activities and links to shady figures.

Marouf does business with HSBC in Britain, but it is the Swiss branch that is linked to his offshore dealings. HSBC in Switzerland is Marouf’s partner in the Gardinia Company registered in the British Virgin Islands, for example.

|

| One of Marouf's HSBC-linked dealings - TNA |

Other banks play a similar role, including Jersey-based Standard Bank Nominees (C.I) Limited, which co-owns Oriental Trading with Marouf.

Soulieman Marouf’s partners include his father Mahmoud and members of his family Ali and Muna, but also members of the Kanaan family including senior officers in the regime’s military and security apparatus, linked to Marouf through his companies and bank accounts.

More importantly, Marouf is reported to have direct ties to the Syrian president, beginning in the 1990s when Assad was just a medical student in London.

But the data leaked from Marouf’s secret bank accounts in 2015 with HSBC in Switzerland, which cover the period 1997-2000, paint a clearer picture of his association to his friend’s regime. Soon after Assad took power in 2000, at least five accounts in the bank emerge, ostensibly linking the two parties.

Other publicly available documents establish Marouf as a major shareholder and board member of the Syria International Islamic Bank (SIIB), along with Ihab Makhouf, Rami’s brother and cousin of Bashar al-Assad.

|

Marouf is reported to have direct ties to the Syrian president, beginning in the 1990s when Assad was a medical student in London |  |

The US Department of the Treasury designated SIIB for acting for or on behalf of the Commercial Bank of Syria and providing services to the Syrian Lebanese Commercial Bank, both of which are subject to US and international sanctions.

SIIB, the US says, has acted as a front for the Commercial Bank of Syria, which has allowed that bank – Syria’s largest commercial bank – to circumvent sanctions against it by the United States, the European Union and the Arab League.

However, the EU lifted the sanctions on the bank in mid-2014 based on the same verdict that led to the annulment of sanctions against Marouf.

Marouf is a direct associate of Rami Makhlouf himself, as mentioned earlier. In addition to Sham Holding, they are partners in the Islamic Company for International Mediation and Services, founded in 2008. Rami Makhlouf’s investment in this company comes through his US- and EU-designated firm Ramak TP.

The New Arab can also reveal, based on Syrian company registration records, a direct partnership between Marouf, and regime-linked businessmen Mohammed Hamcho and Khaled Qaddour through Tatwir, a contracting company founded in 2008 in Syria.

|

SIIB, in which Marouf is a shareholder, has acted as a front for the Commercial Bank of Syria, which has allowed that bank to circumvent sanctions against it by the United States, the European Union and the Arab League |  |

'The Fat Man'

Soulieman Marouf is a supporter of the propaganda calling for the repression of protesters in Syria though television channels he owns, wrote Mossack Fonseca’s compliance director in one of the documents examined by The New Arab.

The email, addressed to senior management in the consultancy, also pointed out suspicions regarding money laundering activities involving Marouf. Nevertheless, Mossack Fonseca did not end its dealings with the businessman according to the same documents.

These suspicions might help explain the association between Marouf and controversial figure Fouad Michael Zayat (75), aka the Fat Man, a known conman, arms dealer and gambler.

Zayat, a Syrian who also holds Lebanese, Cypriot and Portuguese passports, was convicted last year by a Greek court and sentenced to life imprisonment in absentia over money laundering counts in Greece.

He has been a wanted man in Europe since 2015, and is hiding in Syria according to Greek police. The case involved former Greek interior minister Dinos Michaelides and his son Michalis, who were sentenced to 15 years in prison on counts of bribery and money laundering through Zayat’s offshore bank accounts and companies.

This was in relation to the purchase of TOR-M1 anti-aircraft missiles by Greece during Akis Tsohatzopoulos’ term as Greek defence minister.

The New Arab can reveal that Zayat is a partner of Mahmoud Marouf, Soulieman’s father, through the Halsey Management Limited company registered in the British Virgin Islands.

|

The New Arab can reveal that Zayat is a partner of Mahmoud Marouf, Soulieman’s father, through the Halsey Management Limited company registered in the British Virgin Islands |  |

An urgent email sent by Mossack Fonseca asks the British branch to be careful about dealing with Zayat, citing how he defrauded the Iranian government over a deal to purchase Airbus planes, using the funds to pay off gambling debts without delivering the planes.

The man and his daughter Sara had their assets frozen in London in 2008 because of this case, but it was not pursued further, allowing him to flee.

The Sunday Times quoted Zayat in 2007 as claiming that he was kidnapped by Iranian Revolutionary Guards in 2004 in Beirut, and was held at the Iranian embassy until he pledged to return the funds he took from Iran.

According to documents obtained by the author of this investigation, Zayat’s activities were moved through offshore holdings to Cyprus and Lebanon, through companies owned by him, his daughter, his sons, and other associates.

These include FN Aviation Systems Limited, Samata Limited and Gol Sun Leisure (CY) Limited (Cyprus). And Tan Oil, Zaficorp Petroleum, Homaco Lebanon, Technology Maintenance Center, Lextim, Sky Link Exectuive, Gulf Transport Utilities among others, all offshore companies based out of Lebanon.

Neither Soulieman Marouf nor Fouad Zayat and their representatives have answered requests for comments by the time of publication.

Original Arabic investigation by Nizar al-Ghazali.

Additional translation and writing by Karim Traboulsi.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News