Welcome back, OPEC

After the Organization of the Petroleum Exporting Countries and a large group of non-OPEC countries had reached the "historic" agreement to cut oil production, the prices jumped comfortably above $50 per barrel.

So, is this a great OPEC comeback or just a short intermezzo before the cartel's long-forecasted slide to irrelevance?

Anything but harmonious relations between the major parties involved suggests that the impact upon geopolitics among them will be quite profound. In addition, one also wonders whether OPEC members will keep their word regarding production cuts.

"OPEC has been declared dead already 20 times, and every time OPEC survives and still influences the market to an extent not known by any other group in the global economy," Dr Cyril Widdershoven, senior consultant and SVP Research at MEA Risk LCC, told The New Arab.

Dr Sijbren de Jong, a strategic analyst at HCSS and lecturer in geo-economics at Leiden University, adds that, even if the deal ultimately falters, "it will not lead to the formal end of OPEC, but it will exert more downward pressure on the oil price".

Given OPEC's poor track record of sticking to promises, to do so now could present a great challenge.

However, according to Dr Widdershoven, the world's financial giants do know this, and will always include this fact of life in their own assessments - and real OPEC compliance has never been the case.

| Read more: Qatar's big oil deal with Moscow |

"Still, at present, optimism about the deal should still be there, looking at market fundamentals and the fact that most Arab producers will need to have a kind of ceiling or bottom in the market to bring their government budgets again on par with income and revenues," he points out.

"As long as the Arab producers are complying with most of the agreed-upon freeze levels, the success will be there."

|

|

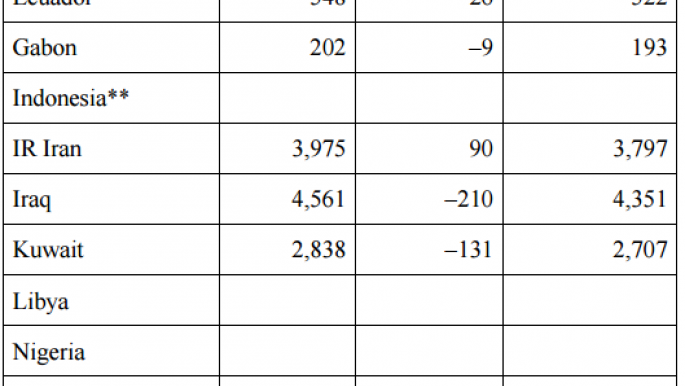

| Numbers shown are in hundreds of thousands of barrels produced per day Source: OPEC |

Keeping the word

And it seems this time the Saudis mean business, as they managed to push other OPEC members to use secondary production figures - prepared by six independent agencies whose measurements are much more reliable than figures presented by member states - in order to ensure compliance with the agreed quotas.

The bloc also established a monitoring committee comprising Venezuela, Kuwait and Algeria.

However, the first reports of Iraqi Kurdistan producing more than it was supposed to are already emerging. That said, Iraq itself has to keep on producing as it needs every bit of hard currency it can get its hands on in the fight against IS, de Jong noted.

But Dr Widdershoven has serious doubts about Iraq's so-called production increase, as the country has not been able to reach even the levels that the market has been expecting for years.

| Read more: Pouring oil on IS - OPEC deal boosts Iraq's war budget |

Moreover, Nigeria and Libya are exempt from the production cut, so they will ramp up production when they can.

"As regards non-OPEC, we still have to see whether Russia will live up to its promises this time around. It will be notoriously hard to monitor anyway, as all of Russia's oil transits via pipeline," de Jong said.

Finally, despite many media announcements about Iran's big comeback, Dr Widdershoven remains reserved, as US sanctions have been prolonged, threatening sanctions on any company (Western or Asian), working in the US or listed on NYSE, if they work with Iran.

"This includes the US banking system, on which most international transfers still rely. Production increase in Iran also will be fledgling as long as Western technology is not able to be put in place," he continued. "Asians and Russians will be able to operate in Iran; however, they don't have the knowledge of most challenging operations."

But Benjamin Zycher, John G Searle Chair and a resident scholar at American Enterprise Institute, thinks it is unlikely that the production cutbacks will be preserved for more than several months, and some in the market are dubious about even that.

Doubts have been cast over Russia's stated cut in particular, as Moscow will supposedly go from a stated production level (over 11 million barrels per day) that many analysts say was unrealistically high to start from.

Also, "there are too many ways to cheat without appearing to do so; 60-90 days credit for payment instead of the customary 30 days is an example. In any event, even without such cheating, supply responses in the rest of the world are likely to be about 200,000 barrels per day each year, yielding price cuts of about $2 per barrel per year, other things held constant," Zycher told The New Arab.

Economy vs politics

Additionally, geopolitical differences have often been an apple of discord among key stake holders in the deal. Even now, Iran and Russia (a non-OPEC member) are fighting two proxy wars against Saudi Arabia in Yemen and Syria, and many seriously doubt a long lasting compromise between them.

But rival states have managed to put their differences aside for the time being, especially after the Russians entered the game acting as mediator, particularly between Iran and Saudi Arabia.

Dr Widdershoven is convinced that the cooperation between Saudi and Russia will continue - as both need a price bottom in the market to sustain their own economies. Both are elite-ruled so commercial factors are not always taken into account, but the survival of both depends on a regular influx of crude and gas revenues.

He further states that, since OPEC is basically dominated by Saudis and other Arab nations, the role of Iran is much smaller than 10 years ago, when Tehran had a growing bloc supporting it, including Venezuela, Algeria and Iraq. At present they are on their own, and other members of the band are unhappy with Iran, with its regime - while the position of non-Arab producers, such as Nigeria, Angola and Venezuela is under severe pressure.

Therefore, "there is no real reason to expect that Iran can rip OPEC apart in the near future", said Widdershoven.

| Read more: 'Historic' OPEC deal allows Iran to boost production |

Benjamin Zycher says the impact of the agreement will be modest, and will decline over time. The geopolitical rivalries are important, but are not the central problem. Within a collusive agreement to raise prices, any given producer has a powerful incentive to undercut the other producers, as doing so increases revenues.

Thus he seriously doubts that OPEC will be disbanded formally, but the Saudi ability to raise prices internationally will never be what it was in the 1970s.

Saudi (old) new strategy

So, does Riyadh carrying the lion's share of cuts - reducing output by almost 0.5 million bpd to 10.06 million bpd - mean admitting the failure of their strategy to retain market share while the oil price was falling?

|

|

| OPEC is under pressure to make sure there's a rise in oil prices [AFP] |

Despite the kingdom's numerous public declarations that it could comfortably withstand a slump down to $20 and even $10 per barrel, it became clear that low prices have been hurting the country as much as its neighbours.

The country has been facing a large fiscal deficit of 20 percent, even after adopting numerous belt-tightening measures. Kuwait's deficit stands at 12 percent and UAE's is nine percent.

Meanwhile, Saudi foreign reserves, estimated at $724 billion, have begun to fall dangerously. Thus some kind of deal over price stabilisation became a priority with Saudis. And if there was going to be any cut, it was pretty clear from the outset that Saudi Arabia had to bear the brunt of it.

The kingdom has been putting this off for a long time in its bid to curb US shale production, but the shale industry proved remarkably resilient. "If indeed OPEC had not intervened this time around, a lot of political capital would have gone to waste," Dr de Jong said.

But nevertheless, Riyadh's strategy is still in place, according to Dr Widdershoven. Saudi deputy crown prince Muhammad bin Salman has put his strategy on hold, partly to force a price increase before Aramco's IPO is launched - which may possibly be worth more than $2 trillion.

This is of more importance than making Iran happy. Also, Saudi Arabia's market position has always been based on being a swing producer, and currently they are not producing as much as they can.

There are no additional volumes available to support the market if there is a real need, due to further war or other crises. Saudi and Arab producers are not looking at a real substantial cut; it has been mostly a freeze of current official production.

So, according to Dr Carole Nakhle, director of Crystol Energy, 2017 is going to be a major test for OPEC and its ability to act coherently.

So far, OPEC has succeeded in setting a floor to the oil price, even though the deal has not yet been fully implemented.

"Prior to the deal, some analysts were forecasting an oil price below $30 a barrel. That said, the market seems to have put a ceiling on the oil price," said Dr Nakhle.

"If the deal is properly implemented by both OPEC and non-OPEC countries, it will take some time to absorb existing inventories and any increase in price will be met by an increase in activity in US shale oil which can dampen the effect of the deal. Depending on the market reaction, OPEC may revisit its deal after six months. Any further production cuts will risk OPEC losing market share."

But, all in all, "it is definitely not the swan-song of OPEC" concluded Dr Widdershoven. "The cartel is strong enough, non-OPEC is fledgling, while demand for crude is still growing."

Stasa Salacanin is a freelance journalist who has written extensively on Middle Eastern affairs, trade and political relations, Syria and Yemen, terrorism and defence.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News