The New Arab can reveal Lebanon and Israel are considering a resource swap that would divide offshore reserves in the disputed areas equitably between the two countries, after US-brokered indirect negotiations to demarcate their maritime borders stalled.

Following a visit by US Energy Envoy, Amos Hochstein, to Beirut, a well-informed Lebanese source with knowledge of the negotiations told The New Arab that the current negotiations are now moving to discuss a resource swap deal, rather than geographical lines to demarcate the contested areas.

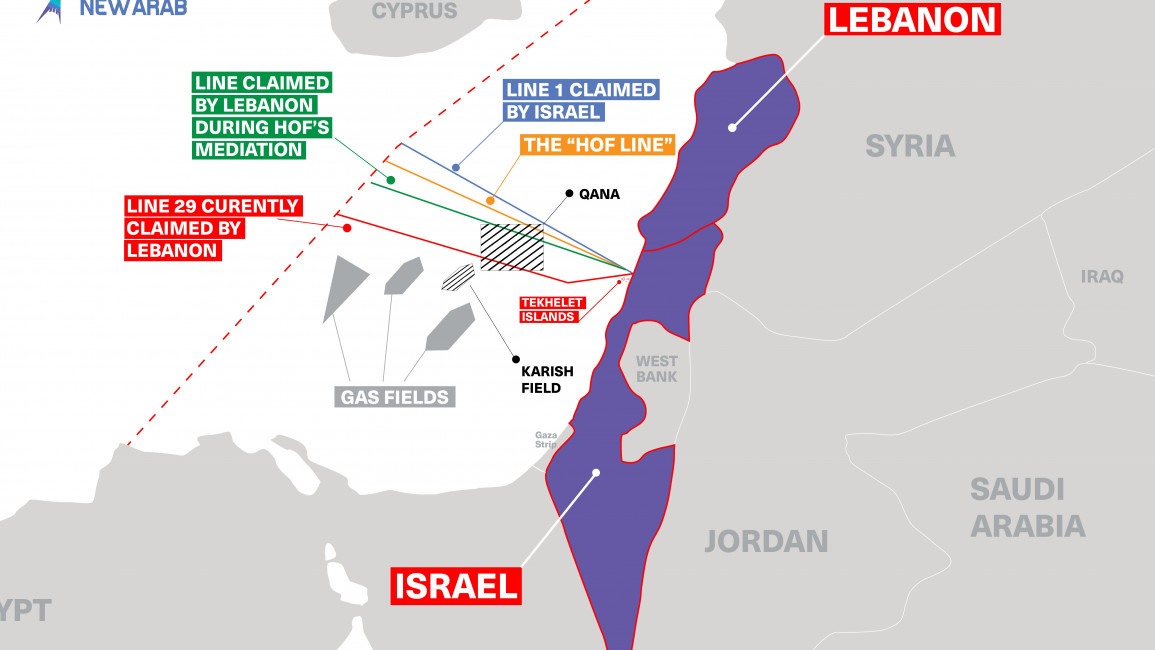

Lebanon and Israel have been engaged in a maritime dispute for over a decade, with no fixed border between the two countries. Despite on-and-off again negotiations, no solution has been reached to establish an accepted maritime border between the two, which remain technically in a state of war.

At stake are offshore hydrocarbon reserves, which if estimates prove correct, could bring billions in revenue to both countries. Neither country has been able to extract gas from the reserves in the disputed zones yet, largely due to the ongoing dispute.

|

|

On the Lebanese side, direct negotiations -- and any dealings -- with Israel are politically sensitive as Beirut does not recognise the state of Israel's sovereignty over what is says is occupied Palestinian territories and natural resources.

The specifics of the plan –which resources will be swapped and how they will be divided – have yet to be decided between the two parties.

However, the source said that an example of one such swap could be the Lebanese dropping its claim to the Karish gas field, so that Lebanon gets the entirety of the Qana gas field and can benefit from its production.

An as of yet undetermined mechanism would be set up under the deal to ensure that if any new assets are found in the future, they will be distributed without the two parties having to start negotiations anew.

Previously, negotiations had stalled because of what Lebanon was calling Israeli “preconditions” which would have limited negotiations to a disputed area of 860 kilometers. Israel for its part, rejected what it characterised as last minute “maximalist claims” by Lebanon to expand the negotiations to an area of 2,290 km.

The Israelis have lightened their insistence on limiting discussions to the 860 km area, the source said. While the Israelis have not abandoned the bargaining position altogether, there is an “openness” from their side to widen the area under dispute under this new resource-swap approach.

A sense of optimism has emerged in the latest round of negotiations with all sides eager to get the deal done. “Now we are at a trust-building phase,” the source said, describing the negotiation status quo as “positive, but fragile.”

"Lebanon and Israel have been engaged in a maritime dispute for over a decade, with no fixed border between the two countries"

New approaches

The “resource-swap” approach is a departure from the focus of the maritime negotiations over the past decade, which has sought to draw a line in the sea acceptable to both parties. That line would become Lebanon and Israel’s new maritime border and would determine the ownership of any offshore resources.

Various solutions have been proposed in the past, including the so-called “Hof line” which would have given Lebanon 55 percent and Israel 45 percent of the disputed zone, respectively.

The Hof line – named for then US mediator Ambassador Fredric Hof – was the closest the two parties have come to a solution, gaining nominal approval by both sides in 2013, but ultimately not being ratified by the Lebanese government.

Today, the Lebanese side feels it has more bargaining power than it did in 2013 and have abandoned the Hof line, viewing it as favouring the Israelis. In specific, the Lebanese think that the role of the Tekhelet islands – a series of small unmanned islands owned by the Israelis – have an outsized effect in pushing the Israeli exclusive economic zone, which they see reflected in the Hof Line.

The Lebanese side also feels the current negotiating team has more expertise. The current team includes both a petroleum and a legal expert, whereas the 2013 team under Najib Mikati was limited to cartographic experts from the Lebanese Armed Forces and businesspeople who were not subject matter experts.

Other proposed solutions include making the disputed zone a “shared zone” where both sides could exploit offshore resources, with the proceeds put in an escrow account to be split by a third party between the two countries.

Lebanese media reacted badly to this proposal however, likening it to a form of normalisation with Israel. The resource-swap approach would help avoid such a PR disaster, as each country would have sole ownership of their resources.

Cooperation and transparency, despite the tension-fraught relationship between the two countries, is key, especially given that the two countries have to agree on what determines an "equitable" distribution of resources.

New pressures

Both the Israelis and the Lebanese feel that the other side is under a unique set of pressures which is pushing them back to the negotiating table.

The Israelis see Lebanon’s increasingly dire economic situation – described as one of the “top three economic crises” in nearly 200 years by the World Bank – as leverage against the Lebanese.

The US also sees the timeline working against the Lebanese. It would take about seven to eight years before Lebanon would see a profit from the gas extracted from the reserves. Lebanon’s main customer for the gas would be Europe, which has stated that it wants to be “climate neutral” by 2050.

Hochstein made an allusion to this narrowing window for Lebanon in an interview with Lebanese media on 9 February, saying that “not reaching an agreement means missing out,” in the context of the global move away from hydrocarbons to renewable energy sources.

Lebanon, for its part, thinks that Israel also has a looming deadline. Energean, the Greek energy company which has the rights to exploit the Karish energy field, has taken out a $2.5 billion loan to finance the Karish project. The first instalment of that loan, some $625 million, needs to be repaid by first quarter 2024.

Production of the field has already been delayed once – nominally due to the COVID-19 pandemic. According to Energean, the project should become operation in mid-2022, with first gas being produced in the second half of 2023.

Energean has not said outright that it will not move ahead with production without a fixed maritime border. However, the prospect of implementing a multi-billion dollar project in contested waters does not inspire confidence.

On the Lebanese side, French energy giant Total said that it will not drill in contested waters.

Both sides have much to lose if maritime negotiations stall once again. The cautious optimism of this round of negotiations however, suggests that a win for both countries could finally be on the horizon.

William Christou is The New Arab's Levantine correspondent, covering the politics of the Levant and the Mediterranean.

Follow him on Twitter: @will_christou

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News