Oil price surges following OPEC deal to freeze production

The price of a barrel of crude jumped five percent following the announcement, with analysts including Goldman Sachs predicting a rise of up to ten percent.

The consequences are likely to be huge, from the coffers of the Gulf to renewed national infrastructure projects to the price of filling your car with petrol.

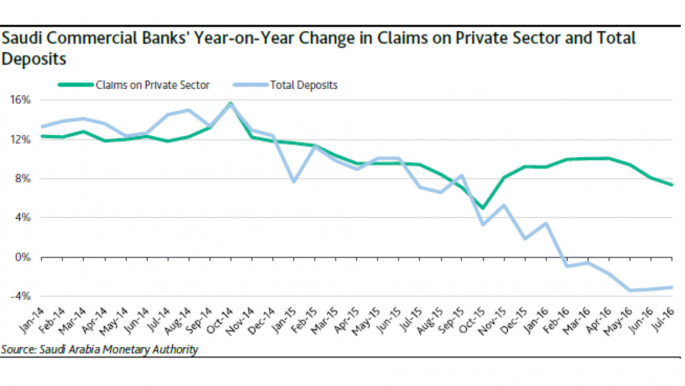

On Sunday, Riyadh's central bank was forced to inject an additional 20 billion Riyals ($5.3bn) into Saudi banks to help them stay afloat.

"These moves follow prior deposit injections of approximately SAR12 billion since the start of the year and are credit positive for Saudi Arabia's banks, which continue to face pronounced liquidity pressures as a result of recent deposit outflows, a consequence of depressed oil prices," Moody's credit rating agency reported on Thursday.

|

|

| The liquidity of Saudi banks was being put at risk by low oil prices |

Created in 1991, the IEF is an informal exchange, consultation and dialogue meeting between producers and purchasers. Its dealers control 90 percent of global supply and demand.

On the sidelines of the forum, members of the Organisation of the Petroleum Exporting Countries came to the agreement after low prices were estimated to be costing oil-producing nations between $300 and $500 million - every day.

The renewed revenue streams for the cartel's member nations are likely be injected into research, oil exploitation and in further investments, said Noureddine Bouterfa, Algeria's energy minister.

"The issue that OPEC has to confront arises particularly in the mid-term and short short-term," the minister had explained before the deal was announced. "In the mid-term, with the decline in oil investment, it risks a shortage of supply. Prices will be so high that the entire global economy will be heavily penalised."

Many member countries of the organisation had already reached the maximum of their capacity in terms of production.

"The ideal plan lies in the freeze in production, but freeze on what basis?" Given the difference between the actual production of OPEC countries, estimated now at 33.47 million barrels per day and the theoretical projection of 32.5 million barrels per day, a cut will necessarily lead to a decline in actual production, rather than the stockpiling of full barrels.

Algeria and Venezuela had backed the idea of cutting the production, facing initial opposition from Saudi Arabia and Iran, whose geopolitical rivalry was united in OPEC's bid to push US shale producers into bankruptcy.

|

| [Click to enlarge] |

"We will not come out of the meeting empty-handed," Algerian energy minister told the press the day before the summit.

Since prices began sliding in 2014, OPEC has failed to reach agreement to constrain production levels at three formal meetings.

In April, the most recent discussions between OPEC in conjunction with Russia held in Qatar's Doha collapsed without agreement as Iran refused to be party to any agreement that would necessarily require it to cut its production levels.

Saudi Energy Minister Khali al-Falih told reporters then that opposition would be fierce. "This is a consultative meeting… We will consult with everyone else, we will hear the views, we will hear the secretariat of OPEC and also hear from consumers," he said.

OPEC's next formal ministerial meeting is expected to take place in Vienna November 30.

Algeria, Iran, Saudi Arabia and most other OPEC countries are economically dependent on oil. Their economies have seen record deficits caused by the tank in oil prices, finding themselves forced to introduce cuts in their running budgets. For some, these have been heavy cuts.

OPEC's strategy has been to pursue market share at the expense of price. This strategy forces higher-cost producers, such as Amrican and Canadian shale oil, to rein in production.

| | |

| Watch now: Video highlights of the deal |

Oil prices had largely stabilised in the $40-50/barrel range for the past six months.

In August, speculation that the world's major producers could agree to a freeze in production rose oil prices. On Monday, oil prices increased again as the deal appeared more likely.

But Iran's oil minister, Bijan Namdar Zanganeh, appeared to quash the rumours, saying Tehran didn't want the informal OPEC meeting on the sidelines of Algeria's summit to reach an official decision.

"Iran would prefer that Wednesday's meeting is limited to consultations between OPEC member countries on production of the organisation and that the final decision is to be adopted at the meeting of Vienna in November," he told reporters during the meeting's first day.

The rivalry between Iran and Saudi Arabia had looked set to lead only to an increase in production, Bjarne Schieldrop, chief commodities analyst at SEB Markets, told Reuters: "The lack of a deal in Algeria would result in further downside pressure on oil as Saudi Arabia would maintain elevated output levels and Iran would boost supply too."

Since the 14th IEF meeting, held in Moscow, the world energy market has dramatically shifted, with both short and long-term consequences.

International oil prices have halved mainly due to a weak global economic growth and oversupply, leading to oil exporters' revenues in freefall and a reduction in oil investment, with risk of a supply drop in the mid and long-terms.

Similarly, the natural gas market has seen a downward trend caused by the high oil production capacity.

Follow Massinissa Benlakehal on Twitter: @mbenlakehal

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News