Concerns as Egyptian Pound due for another devaluation

Recent statements by Egypt's Central Bank chief on the possibility of another devaluation of the Egyptian Pound have raised fears of a widening gap between official and unofficial currency rates, as well as a looming hike in food and imports prices.

Tarek Amer, who took office in November, described defending the pound over the past five years as a "grave mistake".

He added in interviews published on Sunday that authorities can no longer delay measures that would control the use of foreign currency.

Under his leadership, Egypt's Central Bank is focusing on reviving the economy rather than stabilising the exchange rate, he said.

"We have two choices: either keep the pound stable or get factories working," Amer told the Cairo-based financial daily al-Mal, adding that the exchange rate should reflect market and economic forces.

"I will take what I think are the right decisions, in my view, and bear the responsibility."

Foreign currency inflows have been severely hit in import-dependent Egypt after a 2011 uprising drove away tourists and foreign investors, two major sources of hard currency. The dollar shortage has since stifled business activity and hit confidence in the Egyptian economy.

Reserves tumbled from $36 billion before the uprising to around $17.5 billion in May this year, and foreign currency reserves have been further drained this month as Egypt returned a $1 $billion deposit to Qatar and paid $720 million in fees to the Paris Club.

The Central Bank has been rationing its dollar reserves through regular weekly sales, keeping the Egyptian pound artificially strong at 8.78 pounds per dollar. However, black market traders said they were selling the dollar at a range of 11-11.04 pounds per dollar on Sunday, without giving volumes of trade.

In March, Egypt devalued the pound by 13 percent in an effort to close the gap between the official and parallel rates, but the biggest one-time devaluation since 2003, which Amer described as a "corrective move," has failed to boost dollar liquidity or close the gap.

|

We have two choices: either keep the pound stable or get factories working. - Tarek Amer |

|

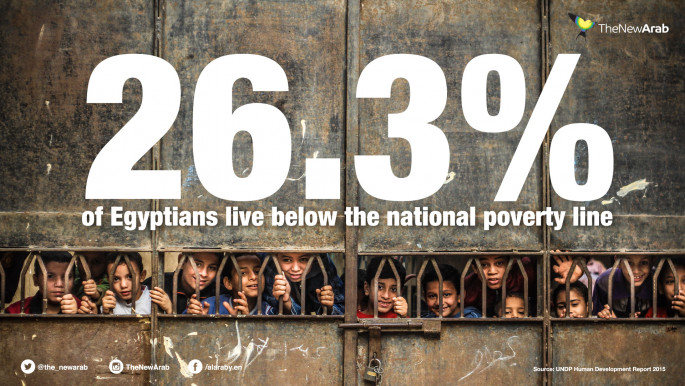

Another devaluation could trigger a hike in inflation if implemented early this year, economists say, a major concern in the country of 90 million, where more than 26 percent of the population live below the national poverty line.

According to Ahmed Shiha, the head of the importers' division in Cairo's Chamber of Commerce, the upcoming devaluation will lead to an "economic catastrophe".

|

The dollar rate will increase in the black market as importers and manufacturers desperately try to buy it at any cost in fear of future increases, he told The New Arab.

In addition, Shiha accused Egyptian exporters of being part of the dollar crisis in the country, as they "manipulate invoices" and "transfer dollars into personal accounts" to avoid using Egypt's banks.

According to official statistics, Egypt imports 60 percent of its consumption, and more than 50 percent of its factories import their raw material from abroad, which means local markets will witness another wave of price hikes in the coming period.

According to Economist Abdel Nabi Abdel Muteleb, another devaluation will do more harm than good in Egypt's case.

A gap of more than 30 percent between official and unofficial dollar exchange rates has deterred investments in Egypt, he added.

![Egyptian Pound devaluation [Getty] Egyptian Pound devaluation [Getty]](/sites/default/files/styles/image_345x195/public/media/images/710A6B70-0790-416A-A7E9-93EEDA01DAFE.jpg?h=d1cb525d&itok=T-DQGzkj)

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News