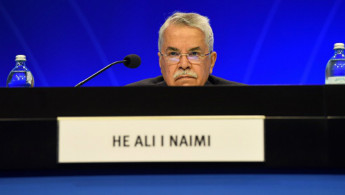

Riyadh rules out production curb as oil prices drop

Ali al-Naimi implied reducing output was "not an option" for the kingdom, in comments published by the Saudi-owned al Hayat daily.

"Forget about this topic," he said. "Oil prices are always volatile."

Naimi's comments followed another credit rating downgrade for the country, after Fitch lowered its view on the oil-rich kingdom in light of the fall in energy prices on Tuesday.

Fitch said it was reducing its rating on Saudi Arabia by one notch to AA- from AA, and warned that another downgrade was more likely than an upward revision - keeping its outlook on the country at "negative".

Meanwhile, members of oil-exporting cartel OPEC and non-OPEC producers are set to meet on Sunday in Doha to discuss freezing production at January levels.

Saudi Arabia's production levels in March remained almost equal as in January.

Iran has said it would not join any freeze as it is still ramping up production following the lifting of nuclear-linked sanctions in January.

Saudi Arabia's deputy crown prince Mohammed bin Salman has said the kingdom, OPEC's top producer, would only freeze output if Iran and other major producers were also on board.

OPEC on Wednesday warned in its April report that the world remains awash with crude, but said oil prices rose more than 20 percent in March, continuing a slow recovery from the huge drop of 2014-15.

Oil prices have fallen sharply over the past two years on a combination of factors, including worries over the state of the global economy in light of the slowdown in China.

Saudi Arabia's decision to maintain production levels even in the face of lower oil prices has also helped oil prices to tank.

Though lower oil prices hurt Saudi Arabia's immediate revenue stream, they also stand to drive many US shale gas producers to the wall.

Agencies contributed to this report.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News