Coronavirus exposes vulnerable GCC markets to a glimpse of post-oil reality

Energy demand in Italy alone has decreased 10 percent compared to its five-year average for March as the country endures its second week of lockdown. Saudi Arabia and Russia meanwhile have faced off in OPEC+ about production cuts, and Saudi Arabia has since then taken the aggressive tack of offering oil to European markets at heavily discounted prices, as low as $20 per barrel.

Nonetheless, it still requires a price of $82 per barrel to balance its budget, and prices currently hover around $22 per barrel.

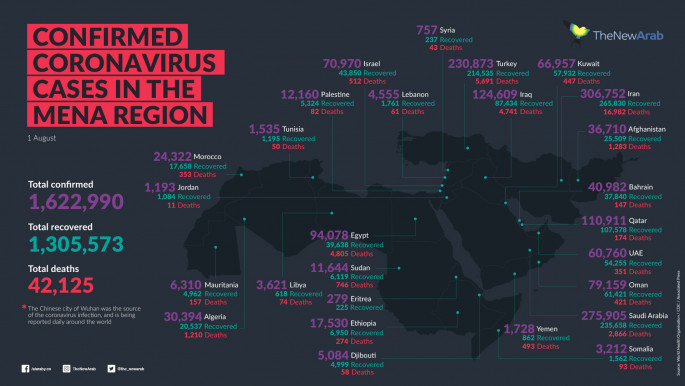

The impact of the crisis varies across the Middle East but demonstrates overall the extent to which energy producers are exposed to the decline in global energy markets as well as the far-reaching consequences of their economic contraction. In some ways, then, we are seeing how the GCC states would fare if they could no longer rely on their hydrocarbon assets as they have aimed to do.

Meanwhile, for energy importers like Jordan, Morocco, and Tunisia, the decline in energy prices is a welcome break, particularly as they are suffering the loss of tourism. For Egypt, which has in recent years expanded its LNG production, lower energy prices could aid in some domestic development, though tourism has already declined and fees from the Suez Canal are likely to decrease as well.

All of the GCC energy producers meanwhile have implemented a variety of stimulus packages to aid their populations - both expatriate and citizen - to weather the storm of coronavirus declines, demonstrating just how exposed their economies remain to global markets.

|

Layoffs in the airline and tourism sectors are likely to continue |  |

Of particular importance has been extending support to small and medium businesses, which all of these countries have encouraged as part of their ambitious (yet largely unrealised) plans for economic diversification away from hydrocarbon products.

Coronavirus has revealed just how much GCC domestic economies are exposed to international energy markets not only through their hydrocarbon production, but also through their airline and tourism industries which have received substantial investment in recent years.

Indeed, the GCC states have sought to diversify their economies in similar ways through, for instance, investments in airlines, tourism, and the hosting of international events – all of which now have an uncertain future. Airlines have been the first to make cuts: Emirates and Etihad have announced that they will halt flights for two weeks, while Qatar Airways has announced a plan to cut 75 percent of its capacity in response to the decline in air travel after the coronavirus outbreak.

|

|

| [Click to enlarge] |

Layoffs in the airline and tourism sectors are likely to continue and will have global consequences due to their large expatriate worker populations. Indeed, the lack of remittances will be felt keenly in countries such as India and the Philippines, which send thousands of workers to the GCC.

Still, Kuwait, Qatar, Saudi Arabia and the UAE, for example, can rely on substantial financial reserves until the energy markets recover, and indeed appear to be doing just that with the announcement of new stimulus packages.

Interestingly, we may see some division between Abu Dhabi and Dubai, as the former is said to enjoy much larger financial reserves, estimated at $1.3 trillion, and is less exposed to the projected losses at a potential cancelation of Dubai Expo 2020.

|

Bahrain and Oman, which have long been the weakest of the GCC economies with fewer cash reserves to draw on, are likely to struggle |  |

Bahrain and Oman, which have long been the weakest of the GCC economies with fewer cash reserves to draw on, are likely to struggle. Indeed, Oman's newly developed gas reserves cannot be exploited, largely due to the drop in LNG imports to Asia.

It may seek bailout from the UAE, but how and from whom it seeks bailout will be telling. Bahrain is similarly exposed yet with fewer energy resources. Nonetheless, it can turn to Saudi Arabia and the UAE for financial support, as it has done in the past.

In a sense, then, the impact of coronavirus on global energy markets provides an indication for how the GCC would fare without their hydrocarbon resources. Indeed, although the GCC states are able to produce energy more cheaply than their competitors outside of the region, the lack of consumption globally will remain an issue.

And while their cash reserves and sovereign wealth fund assets will allow them to manage the current crisis in the short to medium term, there appears to be no longer term strategy on how to diversify economies without hydrocarbon wealth or how to facilitate regional or even global cooperation on energy pricing to help manage similar such crises in the future.

Dr Courtney Freer is a senior advisor at Gulf State Analytics and a research officer for the Kuwait Programme at the London School of Economics and Political Science.

Follow her on Twitter: @CourtneyFreer

Opinions expressed in this article remain those of the author and do not necessarily represent those of The New Arab, its editorial board or staff.

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News